Are you a Motivated Home Seller who can’t afford $10,000 to $200,000 in repairs, $10,000-$200,000 in debt for 10-50 years, or offer seller financing for up to 10-50 years like competing banks to 10% down buyers?

We will cash out your discounted equity TODAY, or no discount on no repairs, with a FUTURE balloon payoff in only 5-10 years

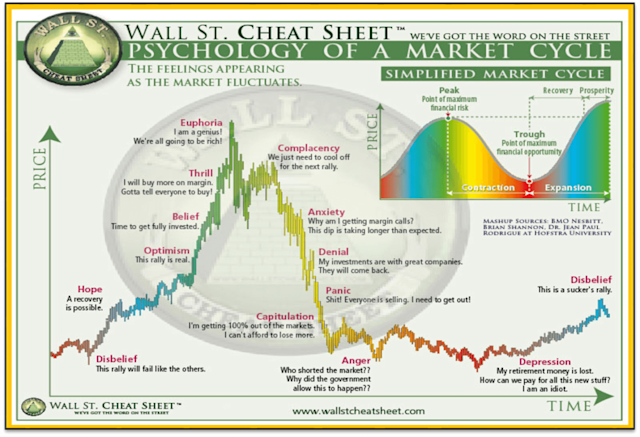

When it’s finally time to sell your Minnesota house you are going to go through an emotional journey with many different emotions.

Depending on your circumstances, the condition of your house, how much time and money you have and the other relatives, family and relationships that you have involved will make a very big difference in what emotions that you go through and how much resistance you have bridging from one emotion to the next emotion. This process is a bridging from beliefs.

You can follow your 22 emotions as a daily habit by following this blog. You’ll want to click any of the 22 emotions below by clicking the links to learn more and start your journey towards the decision to reach out and later text me to sell your home when you feel ready. It will help give you peace of mind and alignment as you first explore and then eliminate your options until you arrive at the solution to eventually sell your home, or property.

Are you, or someone you know going through any of these 22 emotions? Please take a moment to share this article with your friends or someone that will get value from it. It’s very common that an investor, real estate agent, mortgage broker, wholesaler, or home seller will want to read this article as you may know someone or be that someone who needs to sell.

Today you are looking for a transformation and I’m here to demonstrate to you that you can internally create your own momentum by talking yourself up the emotional scale from your current split-energy into more of a path of least resistance.

It’s not your goal to try to skip 10 emotions at once up the scale, but to feel your way up the scale, so that it’s believable to you along the way.

Here is the emotional scale by Abraham-Hicks with over 22 emotions to self-identify with and bridge through, it’s a process, so be patient with yourself.

You may be starting near the bottom, near the middle or near the top. You don’t have to go through all of them right now from bottom to the top.

Maybe you are reading this right now and only need help going through just a couple of these because you are feeling stuck.

Find out which emotion you resonate with today and keep practicing the emotions above it until you get to the top and you have momentum and energy to move forward with inspired action. Keep practicing reading over and over until your emotions and thinking match.

Remember to read from your lower emotion up the emotional scale and fill in the blanks and practice that emotion for awhile with the right thoughts, then move up to the next one bridging gradually, so that you don’t feel resistance.

By practicing this over and over before you text me, this is your path of least resistance. Use this process for your mental health, relationships and finances.

Click on the bold underline linked emotions below for the full article on that emotion to understand it more for how you are feeling and how to bridge and gradually move up the emotional scale with momentum.

You can follow your 22 emotions as a daily habit on this blog. Click any of the 22 emotion links below to learn where you are in the journey to selling your MN house, or property.

1. Joy, Appreciation, Empowerment, Freedom, Love

This is the very top emotion for you and you are going to feel the most momentum and want to take inspired action because you have so little resistance and you have such anticipation of what is to come next because your frequency is so high and you are thinking amazing thoughts and attracting even more of the same amazing thoughts.

Appreciation is Like being grateful and feel emotional freedom from resistance. You love feeling empowered and it’s the peace of mind of joy.

You can’t wait for the new buyer to be happy and love your house the same way you once did.

Just reading saying what you think with this emotion is giving you so much energy, you can’t wait to move forward to sell. In this case click my link at the bottom to read my article to sell and text me for a buyer.

2. Passion

You are so passionate and full of momentum and eagerly anticipate that you ate so close maybe you ate so ready to move on past your house because you know another amazing place is just around the corner to live in.

3. Enthusiasm, Eagerness, Happiness

You are happy and excited and you know now what you want and that’s to let someone else buy your house and use that feeling to eagerly await the next place that you will love, your future is looking bright.

4. Positive Expectation Belief

You now expect and believe that your future is bright and looking positive and you don’t know exactly how it’s going to happen, but you can feel the right people and pieces are coking together.

5. Optimism

Most of your thoughts are turning positive, you have few negative thoughts and your momentum is carrying you into your future reality

6. Hopefulness

You are starting to believe a future ok then horizon could work out for you. You aren’t 100% of the way there, but you ate being receptive to an easier future life

7. Contentment

You are starting to be pretty satisfied, you are starting to be well past relief into some peace of mind. You know you are on the right path and the right timing is coming for everything to unfold.

8. Boredom

You ate getting bored because things aren’t happening fast enough, the good news is you aren’t feeling impatient, you are just waiting on a little momentum

9. Pessimism

You want to take action, you just feel negative and lack believe some, focus on what’s going right and more of the right answers will come to you.

10. Frustration, Irritation, Impatience

When you are frustrated or impatient you know you are close and you know mostly what you want you are just rushing things a little and just need to relax some. Maybe you have to just wait for a buyer to message you back to see your house for sale.

11. Overwhelment (feeling overwhelmed)

Feeling overwhelmed is when your mind feels heavy and it can’t think very clearly because there are so many things to do you just don’t know how to prioritize them. Take it easy and meditate and you’ll think more clearly.

12. Disappointment

Maybe you had some contractors come over and give you some estimates and they are higher than you thought, so your profits will be less than you thought. Don’t be discouraged you aren’t making progress forward.

13. Doubt

You may not believe a person, situation, or yourself, so start off looking forward small things to believe in and have a little faith even in things that you can’t see at first.

14. Worry

Worry creates anxiety and stress and most of it never comes true. Take a nap, meditate, get some rest and remove stress in your life to get above the worry vibration.

15. Blame

Blame makes you feel powerless like something outside of you like your environment or conditions have power over you.

When you think like this you may think of people to blame if you don’t sell fast enough, or get the right price. This is only going to add to your resistance and slow down the selling process.

16. Discouragement

You may have had some bad luck lately and feel like you stopped believing, or things aren’t going your way. Start off with little steps and move forward little by little to build your confidence and beliefs.

17. Anger

You may be angry at some family members in your life right now, but that’s only going to slow you down from having clarity on deciding to sell your house

18. Revenge

This is negative disimpowering thinking where you wish bad on someone else , it doesn’t have to be about a house it can just put you in a bad state of kind and affect you being ready to sell your house.

19. Hatred, Rage

You may be upset that renters trashed your house, or it’s in foreclosure, but don’t use those unhealthy emotions to work against you, read some emotions above with less resistance.

20. Jealousy

You may feel jealous about a friend at work or a neighbor who’s more successful than you selling their house for more money, recognize you feel that way and move up the scale of emotions.

21. Insecurity, Guilt, Unworthiness

At this stage you may lack confidence , or feel guilty about something with a relationship or money and not trust your own instincts on selling your house, maybe you don’t even think you deserve to be happy.

22. Fear, Grief, Desperation, Despair, Powerlessness

This is a tough situation to be in as there may be a recent death in your family, an inherited house and a fight with siblings. You may feel out of control and out of time and money, feeling very depressed and out of energy.

You can listen to an audio about selling your Minnesota house here with Abraham-Hicks example from a guy in the audience and the emotions that go with it https://youtu.be/lS5DpSQaGpg

here is another chart of moving up to alignment on your emotional journey before you decide to reach out and text me to sell your house, or property.

Here is a longer detailed article that I wrote for you to read and click below when you are ready to sell your Minnesota home as-is fast on seller financing terms, or cash I recommend reading it a few times to understand it better before you reach out and text me to sell your MN house, or property.

What makes a property owner motivated?

MONEY/DEBT ISSUES:

Can’t afford payments

Making 2 payments

Can’t afford falling prices/equity

Refinance doesn’t make sense

Inflation burned last of savings

Property taxes skyrocketed

insurance skyrocketed

Utilities skyrocketed

ARM payment escalated

HOA fees escalated quickly

Deliquent HOA fees

Failed investor

Speculation failed

Seller’s Bank collapsed

Stock brokerage collapsed

Job out of state

Depleted short-term $ to fixup/finish

Unemployed, fired, laid off

Unemployment benefits/stimulus ran out

Low Occupancy/high vacancy Airbnb

Builder bleeding cash flow

Vacancy ongoing expenses

Retirement $ running out

Lost $ in crypto

Lost $ in stocks

Lost $ in 401k

Lost $ in pension fund

Negative cash flow monthly

No Insurance to fixup

Owe people money business/personal

Lender Capital call/margin call

Expensive Landscaping & curb appeal

Too much student debt

Pending hard money loan

Strategic walk away

Collect rental income in redemption

Collecting rent not paying lender

Negative leverage cap rates

Calculated ARV or fixup wrong

Contractors took $, work undone

Bad economy fear/panic

Free and clear/seller financing for $

Afraid to raise rents

$0 for capital improvements

CREDIT/EQUITY ISSUES:

Major credit card debt

Credit card limits were cut

HELOC credit line were cut

Credit frozen

Cash-out Refinance denied

Behind on loan payment 1st or 2nd

Loan mod (can’t qualify)

Upside down equity/short sale situation

No equity left

Too young for reverse mortgage

Work Car/truck repossessed

Lender denied buyers

property not financable

Major unpaid collections

FAMILY ISSUES:

Divorce or separation

Recent marriage

Kid custody

Death in family

Probate

Inheritance

Disagree/siblings in selling

Siblings forcing sale

Move out of state for family

Estate sale forced sale

Kids moved out/too big of a house

Expecting a baby/house too small

HEALTH ISSUES:

Major Health issues/expenses

Big medical bills collections

Paying for family assisted living

Paying for family nursing home

Paying for family group home

Parents/family have health expenses

TIME/DEADLINE ISSUES:

Can’t manage property out of state

Walked away from the property

Too busy with life

Too busy to chase rents

Too busy to manage the property

In pre-foreclosure

In redemption period of foreclosure

Balloon mortgage due

Many showings are inconvienent

Hard to show with tenants/condition

Couldn’t sell FSBO

Didn’t sell on MLS (expired)

Agent couldn’t find buyers

Wholesaler left seller stuck

Bank wants keys back for REO

No money for years to finish

Out of time, money & energy

Builders have too much inventory

PROPERTY ISSUES:

Deferred maintenance

Major fire damage

Major water damage

Major mold damage

Major storm damage

Utilities cut off

Major siding, roofing & window expenses

Renter destroyed property

Needs dumpster: junk/trash

Undesireable location

Railroad tracks/power lines

Doesn’t like neighbors

RENTER/LANDLORD ISSUES:

Renter can’t pay

Renter(s) lost job

Burnt out landlord

Renters violated lease

Done being a landlord

Eviction moratorium

Rental management out of area

Absentee owners

Poor manager/operator

No time or money for eviction

TITLE ISSUES:

Delinquent Liens

Delinquent levies

Mechanics liens

Water bill lien

Accessment liens

Lot/land issues

TAX ISSUES:

Delinquent personal taxes

Deliquent property taxes

1031 exchange deadline

Depreciation recapture on taxes

Estate taxes

CITY/STATE/HOA ISSUES:

City ready to tear down

Condemned by city

Code enforcement violation

Airbnb not allowed

HOA won’t allow rentals

On City CAT vacancy list

Seller was defrauded

Seller committed a crime

High Crime in neighborhood

Zoning issue

Environmental issue

Can’t split lots

Non-conforming bedroom(s)

SELLER FINANCING is better than BANK RATES

-99% of mortgages are 6% or less

-75% in 4’s or lower

-Half originated/refi since 2020

-40% loans done from 2020-2021

-39% free and clear homes

-Almost 1/3 rd of mortgages below 3%

-2/3rd of 65+ year olds own free & clear

-Houses change hands every 12 years

-74% of homeowners over the age of 65 have been in their homes for at least 13 years

-more than one-third of homeowners 65 and older have held onto their home for at least 33 years.