Are you a Motivated Home Seller who can’t afford $10,000 to $200,000 in repairs, $10,000-$200,000 in debt for 10-50 years, or offer seller financing for up to 10-50 years like competing banks to 10% down buyers?

We will cash out your discounted equity TODAY, or no discount on no repairs, with a FUTURE balloon payoff in only 5-10 years

“Ron I know that I’m ready, I’ve decided it’s time, I must sell my house quickly As-Is for a fast cash offer, or Seller Financing!”

…I can hear you say out loud as you have exhausted all of your other options and must take action to sell today…

….and your solution today is that you want to know that we will buy your home quickly today…

If you believe that your housing situation is getting worse by the day and you believe that you can’t fix your housing problem by yourself without my help and are frusterated, burnt out, tired of wasting your time, hard efforts, years and life savings on your property then keep reading this whole article many times until you no longer resist reaching out by text message. You’ll find this article to offer to you a perfect customized solution, but it may take you a few full reads before it fully aligns with your beliefs as truth and gives you peace of mind. If you don’t take action to text me, then you haven’t read the article enough yet, you still have resistance.

If you believe that your housing situation is getting better every single day and you have everything ‘100% completely figured out already yourself’ then there is really NO reason for you to keep reading below, you can save yourself a lot of time and leave this article right now.

Let me ask you this…

Do you want to quickly achieve peace of mind today?

….and finally sleep well tonight….

My intention is to have investors with an expanding consciousness in money, health and love be of service for the fact that

Inventory is continuing to grow due to a U.S. Demographic Timebomb from an aging population

4 declining health situations causing an accelerated spend down of their equity and retirement assets leaving homeowners with fewer options due to:

Homeowners Physical health

Properties Condition health

Market House/Stock Price health

US dollar inflation lifestyle health

On the other hand Investor buyers have a growing amount of options and will focus on inexpensive underlying seller financing of your property as a hedge against the 4 declining health scenarios.

You DON’T want to feel trapped TODAY by the other inexperienced local Minneapolis investors who will offer you a LOW BALL offer that you won’t accept.

Then relax…

because with our flexibility…

you DO have…

…another option to keep more of your hard-earned cash inside your pocket TODAY…

(I know, I know, it may sound too good, but I’ve made my solution for you today very easy to understand as you will see me demonstrate by the time you fully finish reading below)…

What you will gain is peace of mind, clarity and alignment after you read until the end…

Here’s what you should do next….

After we decide you are ready to make a decision that you feel good about, I am going to have you text me at my private cell phone # below, and I will give you that number later on towards the end…

I recommend as a motivated home seller to read this article many times and you may also want your trusted friend to read it as well:

trusted friends may be:

Mortgage person

Real estate agent

Investor wholesaler friend

Title person

Probate attorney

Divorce attorney

Tax attorney

City Inspector

Appraiser

Me Knowing local investors with 20+ years experience has taught me that they prefer to offer you TWO contrasting offers.

With either investor types

They choose

price OR terms

Options…

#1 Fast cash low price

# 2 Terms full price

My local Minneapolis investors buying associates are the direct buyer with these TWO offer options, and they’ve purchased many over the last couple of decades.

The likelihood of a closed sale and conversions goes up much higher with your home on option #1 and # 2 as they’ll be motivated and quick to follow up with you…

…imagine those first 2 options as warm referral leads

That’s why you want to avoid being option #3 when possible

As a Minnesota home seller if you choose…

#3 option your price and terms

less of a discount plus fast sale, in other words, in between the above high converting offer types, your price and terms

Then unfortunately for you…

You are perceived as a cold lead, not the quality of a referral lead that successful investors are already busy with…

You’ll have to work very hard on following up with the local Minneapolis investors every other day to stay top of mind since you no longer will be a top priority because they prefer to be the direct buyer at their price and terms.

by presenting your terms and following up with a marginal offer it will frustrate you amd often result in no sale.

When choosing option #3

The twin cities investors will often assign your property to another newer investor, look for long term financing, or less money down.

Here’s a tip…

Let’s answer the question…

Should I sell my MN house now?

The goal is to pre-frame and position yourself as a top motivated Minnesota home seller to want to buy from before the other sellers.

The successful Minneapolis investors that I work closely with have access to millions of dollars, but most are squeezed on time, so they will prioritize which properties they look at it. Most wont tell you this, that’s why you aren’t getting called back, but I know you are thinking, “I want someone to buy my Minnesota house.”

Selling your home Quick could really make you look like the hero to your family this week with a sense of relief and some big smiles.

If you know for sure that you are a motivated home seller keep reading…

If you have already spoken to at least ONE buyer prospect and they have NOT called you back, or bought your home, then keep reading because you haven’t found your ONE solution yet….

Do you want to wait months, or years for 20 buyers to see your home and then not call you back…

…if you said NO then keep reading…

This article that you are reading will help you bridge the gap between your current housing problem and align you with your future house sale quickly.

Right now you feel motivated because you want to release resistance of your split-energy of confusing & competing emotions in your head which affects your everyday life….

Causing you to feel limited freedom.

Later after reading this article, you will be inspired and have alignment, also known as clarity, peace of mind and freedom.

You’ll soon be excited by my new and different approach, allowing you a sense of hope over your failed past experiences that didn’t work for selling your house…

Before we start this journey of deciding to sell your home here today, I want to share with you that it’s my goal to create a connection and bond with you, so that I can build your trust, and I’ll do that by educating you step by step…

This means I will bridge the gap through alignment , starting off with examples of the feel, felt, found method.

This will show you that:

I relate to how you are feeling with your current problem because

I have felt similar with a problem in the past and

Because what I have found as a solution that worked for me, I now strongly believe that it will also work for you, and soon I’ll share that below…

One last quote before we walk through the 5 stages of this journey…

I have found Seth Godin to be accurate with this following short and valuable quote below and I want to break down this quote and explain it to you…

Because you may not yet know me, you may not yet believe me, and that’s understandable.

I want to move past the first step and show you how I can help you with this process of trusting ONE solution that I know that you will believe in my solution by the end of reading this article.

You can look me up on Facebook, Ron Orr, and look at our mutual friends and ask your good friends who have had a trustworthy credible reputation that you can believe.

The last step is that I help you align your emotions to my final ONE solution that you will tell yourself that gives you complete clarity and peace of mind and then you’ll make your decision to text me by the end of this article.

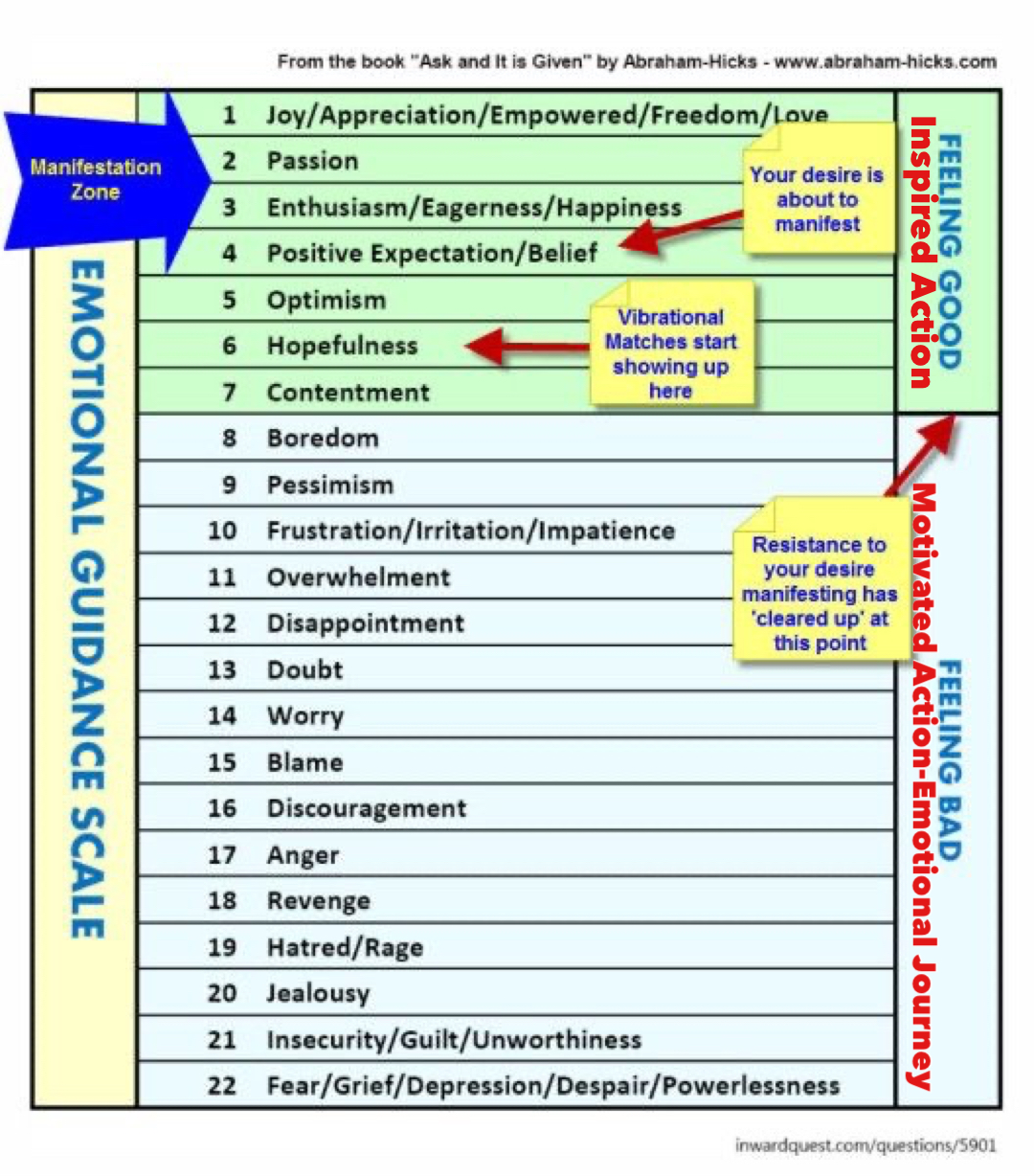

If at any time you need help elevating your mental health, finances and relationships in this selling process please click the 22 emotions that you could experience in these areas, and during the processing of selling your Minnesota house as-is fast

22 emotions Sell your Minnesota house fast cashAs your emotions become more positive you will resonate with taking inspired action of selling your property for the positive reasons.

please notice how you’ll need some space to read and think with your lower emotions as an emotional journey, and it’s not until you get to contentment and positive emotions that you take inspired ACTION.

Now let’s quickly get started on this journey before you text me at my phone number below of your emotional alignment today, for your goal of a fast Minnesota home sale today…

But before we do please take a moment to follow and subscribe on my social media buttons below, so that you can always come back and reference this page…

There are 5 stages of your emotions from beginning to the end of contacting me to sell your home, that we must work through together today on this article to get you full clarity.

Let’s review right now the 5 stages of emotions that you will be going through:

1. Completely Unaware

Before you were aware of your problem, you were probably too busy in survival mode, just trying to keep up with bills and running out of time and options, constantly exhausted and tired everyday.

Due to the awareness of your negative confusing split-emotions in your current daily lifestyle situation, you now know that you are stuck with a real problem.

let’s look into your problem in more detail, in-depth, to better understand what the multiple problems are that you are currently experiencing.

I remember the feeling of this stage myself from my own experience, just being so busy from 2005-2008, day and night.

I’d describe it like this…

With my properties the money was spent before I made it…no matter how hard I worked.

I would think that you are feeling similar to this right now, let’s look at the next step below…

This next step is where I found that identifying the depth of my house problems was an important beginning step towards fully understanding that a solution for me even existed.

2. Problem Aware

First, let’s find out how many of the following housing problem situations below exactly describes yours.

(and I’ll let you know right now, that some may be a little hard for you to accept)…

but I share them only to allow you to self-identify with many of these problems to prove that you are on the right track today by reading this educational article.

Which ones do you relate to?

Assuming that you need to know how to sell your Minnesota home quickly, as-is, any condition, with no repairs made, for a fair price, with no hassles, and no agents or REALTOR® as a private sale?

You are Behind on bank mortgage payments

Your Fixer handyman special house needs thousands of dollars in fixup, ugly, with too many repairs

your property has been condemned

Your Vacant home is costing you thousands of dollars per month

You are deliquent on property taxes, or have an upcoming tax sale

You want to STOP your foreclosure, the sheriff sale, pre-foreclosure process, or you are in the final redemption period

Your brain is gnawing 24 hours per day on ‘these negative emotions’ and you just want to turn it off, and get relief:

fear, grief, depression, despair, powerlessness, insecurity, guilt, unworthiness, jealousy, hatred, rage, revenge, anger, discouragement, blame, worry, doubt, disappointment , overwhelm, frustration, irritation, impatience, pessimism, and boredom

You Can’t afford 2 house payments each month, and it’s costing you thousands of dollars

interest rates are too high now to refinance

interest rates are too high to buy a new home

inflation for food and gas has you falling behind on bills

You are In probate due to a recent family death

There is an Illness or big expense, or complications in your family

you haven’t had time to focus on yourself, or your family’s health

You have a large unpaid Stack of expensive medical bills or collections

You’ve recently Inherited a house that is a hassle to you and your siblings

You are In the process of Divorce

You are in the process of a separation

You’ve been Unemployed or laid off

You are Forced to Move to an assisted living and must sell now

You are Forced to Move to a nursing home and must sell now

You have an Out-of-state, or job relocation

You are Forced to Downsize for budget reasons to save money

You need to Upsize immediately for your growing family

You can’t evict Renters, or you have property damage from renters, or dealing with unpaid rents from the eviction moratorium

You Need to sell your home without scarying your tenant away

You Can’t refinance now due to your bad credit, or recent unemployment

You are behind thousands of dollars on your bills

You Have major deliquent student debt

You Can’t qualify for a new home loan

You Can’t afford your home and need help

Your home and debt Payments are too high

You have unpaid Mechanics liens

You have Bail bond liens

You Don’t know what to do

You Don’t want the house anymore

You Don’t want to deal with the house, you must sell it

You Don’t Have Time to deal with your house

You can’t afford to Maintain your property Anymore

Your home Value is Going Down by the day

You have very Bad Tenants

You feel Unsafe where you live

You are thinking right now Make Me An as-is fast cash offer

You Got a Letter from an Attorney

You are Upside down on your house price, and owe way more than it’s worth

Your house is Vacant and you Never lived there

You Owe tax liens, or have tax levies

You have Major Fire, Water, or Mold damage

Are you Looking to BUY a home right after you Sell with no Banks while cashing in on some of your home’s equity?

When your past credit history is very bad and…

When you have challenging situations like those above…

You know It leaves you with few options

to immediately own your own home again…

because banks won’t easily lend to you,

but the good news is…

when you sell and cash-in on your home’s equity and transfer it to…

I can relate to some of your above problems….

I know back in 2005-2008 I had a few of these housing problems before the housing crash of 2008 and I sure ran out of money and time quickly each month.

Im sure you feel that a lot of the above housing situations sound familiar, you can closely identify with them and they cause headaches emotionally don’t they?

Now I found that being aware that a solution did exist, was a very important next step, so let’s take a look into the solution to solve these problems for you.

3. Solution Aware

At this stage you’ve started to notice the we buy houses Minneapolis cash signs by local companies owned by real estate investors, you know…

the webuyhouses yellow and white signs that you drive by each day, out on the busy local streets on your way to work and you keep thinking…

each time you drive by them, I sure wish someone would buy my house as-is fast now for cash because I’m sick and tired of my housing situation and it’s been giving me a headache daily for months now.

By now, You know you are a motivated Minnesota seller who must sell your home quickly now to a local trusted investor because the kind of retail buyers that you want are very hard to find due to low buyer demand, tight lending or high housing inventory competition from other motivated Minnesota home sellers like yourself.

Your solution today…

you have two main choices…

Choose between selling:

#1) for an upfront discounted cash now in your pocket price, as is, cashing out your equity and paying your home loans off in full

or

#2) choosing a higher over full price, closing later, with owner seller financing, price and terms.

Trusted local investors with decades of investing experience, that I know and trust have collectively bought over 500 homes with each of these offer types:

#1) Cash purchase for quick sale

Or

#2) Over full price off, you sell on terms

1st option (All Cash):

An investor with all cash either has the money in the bank right now, a line of credit, or borrows what’s referred to as hard money.

These cash offers do not include bank qualifying, so they give you an as-is fast cash offer sale of your home.

A Minneapolis house flipper paying CASH doesn’t want to keep money sunk into the rehabbed property for very long, just like you don’t want to, so the investor will plan on fixing up the property and flipping it for a quick resale, so that they can get their profit back out in a 4-6 months.

The CASH purchase option usually is your best FAST option as a motivated Minneapolis, Minnesota home seller, especially when your home needs a lot of fix up work that’s been left undone, or needs thousands of dollars to catch up late mortgage payments or past due property taxes.

Please note…

The more money that the investor buyer needs to come up with out of pocket to sink into the property, the more likely an investor will want it out quickly and plan on offering you a lower CASH price option #1.

Do you want to sink money into your property, or can you even afford to?

Rehab investors usually do a quick inspection, or waive the inspection due to their experience and just want to get clean title work done before closing at a title company, meaning owning clear title without liens, etc.

No matter who you sell and close with you will need to sell with a clear title by the time you get to your closing to receive your money.

For the offer price, generally a trusted experienced investor rehabber will want to buy at 50% of the ARV, or 70% of ARV (After Repair Value) less repairs.

Investors usually won’t tell you this, I’m just letting you know in case nobody is calling you back, you are trying to compete with all of the other motivated sellers out there.

After Repair Value means what would the property sell for when it’s all fixed up in great condition.

ARV is a higher number than those selling in your neighborhood that haven’t been updated in years.

These twi formulas are what the investor buyers are considering to buy your property within the twin cities.

Here are some common reason why your property is less desirable and may not get a buyer, or require even more of a discount that the 2 as-is CASH offers above….

-Your house is out in a rural area

-your house has a septic tank

-your house is in the middle of nowhere,

-your house has one or two bedrooms

-your property is a condo

-your house has foundation issues

-your house has no curb appeal

-your house is near railroad tracks

-your house is next door to a highway

-your house is under powerlines

-your house is in high crime areas

this is because the available market of buyers is much smaller and they would have their money tied up much longer.

Remember to write down my phone number below…

How did the real estate, housing and US economy slow down so much?

Greed: believing that house appreciation would last forever so too many over paid for houses when the inventory was low. Landlords charged too much on rent and raised the prices too much because they could because inventory was low.

Fear: people wanted to sell quickly because they new their equity was evaporated which is their retirement and they are fearful of outliving their money, health becoming a top concern with an aging population.

Fearful of missing out on inventory and over paying in retrospect as their was a large shadow inventory of 2nd homes, Airbnb vacation homes, new construction homes and new construction apartments that hadn’t yet hit the market. A lot of new investors and speculators caught caught up in this frenzy.

Rates went down for over 13 years as peoples lifestyles were dependent on Refinance closing costs every 18 months. Even 20% of businesses where people were employed were dependent on falling rates the following year, or into the future.

Many property or home owners Don’t know how to manage time or money, they aren’t good at budgeting either and aren’t project managers, so there are a lot of time and money leaks that end up compounding for years and decades leading to be a motivated seller some day.

$100s of billions in cash out Refinances on ever growing home prices was used for consumption in the economy, it drove the US economy. So when the refinances go down 70% then eventually there is less cash and credit to spend into the economy.

By March of 2022 9 of 10 mortgages were below 5% while new rates were 5.5%, so why refinance. 33% of the homes were bought by investors and for them to continue to grow they need to do a cash out refinance, but with 6-7% rates eventually those rates don’t work with real estate investor models

Real Estate Knowledge is Expensive

Home Sellers Can’t do this themselves

The real estate investors that I know that will buy your house, many have paid $100,000 to $1 million in specific real estate investing and business conversations.

Few contractors remain at an average age of 60, in the retail market for you they charge a lot in todays labor shortage and inflationary environment. Go ahead and call around you’ll see what the prices are…

A Plumber or electrician costs $200+ hour

our investors have their own crew and employees, but you as a home seller pays retail contractors and with todays inflation as you update your deferred maintenance to try to get your property on the market, expect pricing like this…

Retail cost for a kitchen $60,000-$200,000

Retail cost for bathroom $15,000-$50,000

that’s just a couple main rooms. The best rehabbers are probably paying over twice what they were 5-8 years ago because of inflaton on supplies and labor shortages.

Remember that my investor associates are talking to 2-10+ other sellers per week, so your offer has to look better than the others to rise to the top to be chosen.

new updated notes as of 2023

New buyers want 30-50% discounts when you sell because of high rates

Lenders only offer rate/term and cash-out refi’s at high rates

Lenders use low LTV (Loan to Value) for Cash-Out Refi’s

Lenders lower the LTV even more as the market goes down

New buyers need to factor a possible 15-18% true annual inflation on property expenses.

Supplies

labor

Property taxes

insurance

The White House is discussing rent control in January 2023 headlines

So a new landlord buyer must imagine annual rent caps

Renters are being laid off in 10,000’s in 2023

Renters and homeowners credit cards are maxed from inflation including…high rents, groceries, and gas

Eviction filings are going up

Builders are struggling with too much inventory

Foreclosures will rise, adding inventory

Failed Airbnbs about to hit the market for sale due to saturation and negative, or low cash flow

2nd and 3rd homes may hit the market because of high rates and layoffs

It’s all one big liquidity drain

negative carrying costs and

negative cash flow for many property owners

The Fed is projected to drain one trillion dollars per year I’m hearing off of their balance sheet. That will be like a $2 trillion shift in momentum swing instead of adding $1 trillion in liquidity, it’s removing $1 trillion in liquidity

Maybe in the near future renters get UBI or state assistance with food stamps and landlords will be completely dependent on the government’s funds

Option #1

Sell Your MN House Fast

We Buy Houses As-Is

Fast Cash Offer

selling your house at a big discount can be painful, but not as painful as wasting thousands of dollars chasing hard to find contractors with a major labor shortage as they are retiring now, who charge you an arm and a leg only to be ripped off by the wrong contractor, or simply having it done wrong only to pay to do rip it apart and do it all over again.

Not to mention the price you will pay spending hours at Home Depot on lumber, and other supplies with the skyrocketing costs if inflation.

You don’t have the money upfront and if you did you would have fixed your house a long time ago, so you don’t have the option, the market wlll pay what it pays. The investor buyer is talking on a lot of risks, costs and time to fix this house up and they know the average amount they can make on these houses, and if they don’t buy yours they have 5 more to look at by next week, so their heart isn’t broken if you don’t come down on price and we don’t make a deal today.

You can sit on your house vacant for awhile and keep paying the insurance and property taxes in addition to the maintenance expenses that keep adding up.

Your house hasn’t been fixed, tenants trashed it, or it hasn’t been updated in 20-50+ years you knew this time was coming and you didn’t do anything all of these years because you don’t have the time, health or energy, so the cost is in selling your house in poor condition for your convienence of having peace of mind today and being able to sleep again and get on with your life again.

with a house that needs this much fixup you aren’t going to get a retail buyer because the banks won’t finance it, so the limited option that you have is a cash buyer, and they have other options of houses in far better condition.

Let’s go over the numbers:

As I mentioned above, ARV stands for After Repair Value

That’s the price your Minnesota home would sell for all fixed up in excellent condition to reach full potential value in a reasonable amount of time when your investor buyer later sells this home

The investor will run a lot of comps (comparable prices of sold properties) in your properties area to determine what the accurate ARV is and will also do estimates on repairs based on their experience.

50% of ARV

(This is not to be confused with 50% or 1/2 of the current as-is value that you think it’s worth, it’s based on the future value of the house all remodeled)

In this first example let’s use the numbers…

$300,000 as the ARV and $175,000 as the purchase price, with $35,000 in estimated repairs.

this is a guideline and not a hard and fast rule.

The rehab investor has a lot of fees including closing costs with the title company to buy and sell, often a marketing or wholesale fee, an agent fee to sell, interest costs while fixing the home, points as loan fees on the loan at the time of closing, new supplies on the property, paying contractors, risk of any unforeseen circumstances, and more.

If everything goes amazing the investor makes an acceptable profit based on the risk involved.

The most popular investor formula is MAO (Maximum Allowable Offer)

The math is: 70% of ARV less repairs

$300,000 house x .70= $210,000

Less $35,000 in repairs = $175,000 purchase price to YOU the seller

Please keep in mind that the rehab investor knows when negotiating that most

Motivated Minnesota Homeowners would normally have to pay 5%+ to a real estate agent as a listing fee, plus any mortgage payment costs if the home is vacant, plus any repair costs, staging, or anything to get the house into marketing condition.

Investors know a Twin Cities motivated seller isn’t a general contractor and isn’t going to go through all of the work of hiring, managing and interviewing a bunch of contractors and have 50 people stomp through their home when they list it on the market with an agent worrying about covid-19, etc.

The investor may want the motivated Twin Cities home seller to pay normal selling title fees.

Remember it’s all part of the negotiations with the investor.

As the home seller you were never going to net anywhere near the full amount that you wanted.

Another hard truth is that many homes that are in need of major updates and work simply can’t be listed to a retail buyer even in a hot market because the buyers lender, especially FHA guidelines won’t allow this property to pass inspections and the buyer won’t get financing, so you’ll waste a lot of months and thousands of dollars to find this out.

50% discount just because on interest rates alone.

many retail buyers and investors purchased homes with leverage and stretched the price that they could pay at a 2.5% interest rate. In a much higher interest rate environment when you sell your same house at a 8.8% rate you would have to come down 50% on price just to give them the same buying power. That’s not even including the deferred maintenance that accumulated over the years that you owned your house.

here is the math:

Housing payment, interest portion

Buying power

$3500 monthly payment

$885,805 house price

2.5% interest rate

$3500 monthly payment

$442,884 (50% less) house price

8.8% interest rates

2nd option (Owner Financing):

As a motivated Minnesota home seller if you aren’t expecting the investor buyer to tie up their valuable cash upfront for your property, then the investor buyer can pay as much as full price, or more for your home.

This option is unique to my trusted experienced partners and is rare and you will unlikely find it anywhere locally. They may not return your calls, they’ll answer mine when in intact them as I’ve known a few for nearly 20 years.

Option #2

Sell Your MN House Fast

We Buy Houses

Owner Financing

Price and Terms Offer

It can be painful to not get all of your cash and equity upfront and wait to get your payments over 5-20 years, but you know what’s more painful than that? Paying $10,000s In long-term capital gains tax. Paying $10,000’s out of pocket to fixup the house right now, or dealing with agents and listings and cleaning, etc. It’s painful to pay $10,000’s in depreciation recapture come tax time.

Many choose to retire, or just get a payment stream on your house over the years, or have someone else take over your payments, including taxes, insurance and maybe the homeowners association especially if you fear inflation and rising payments on those.

It’s very painful to outlive your money

It’s very painful to realize that you would likely pass away before the cycle in housing fully rebounds to recapture your equity back from the price crash

It’s Painful looking back to realize that you should have sold your house at the top in the housing market cycle at yesterdays prices and now you regret not doing it, but you have a second chance by getting top dollar with a terms offer

Your house doesn’t have to be free and clear to choose this option, but it can make it easier.

the pain of coming up with money upfront that you simply don’t have or refuse to pay is why you want to take your payments over time.

Let’s go over the numbers:

$300,000 value if the home is in great, or excellent condition

$300,000 purchase price with owner financing

$0 upfront is ideal

0% interest on your free and clear home

Pay your remaining amortization schedule

Deed to your property would be signed over in cases when there is underlying financing with a mortgage

The most trusted and experienced investors who buy with owner financing will always choose 0% interest on free and clear Minnesota homes before the other options with mortgages on the home.

Investors prefer to pay 0% upfront.

Remember an investor has to put money into the Minnesota property to fix it, make the payments, find another buyer or renter, eventually pay an agent to list the home, possible vacancy holding costs of mortgage interest and the time it takes to find a new buyer or renter.

The investor buyer has risk and expenses to consider even after closing the transaction with you.

As a Motivated Minnesota home seller who has an underlying mortgage and not free and clear you’ll have fewer options available for option #2.

-The more money you ask for upfront the fewer investor buyer prospects you will have to sell to on option #2

-The higher interest rate that you ask for over 0% upfront, the fewer investor buyer prospects you will have to sell to

If the investor is taking over your fixed-interest rate mortgage, you as the motivated Minnesota home seller have fewer options than a Minnesota homeowner that sells free and clear.

Did you know…

33% to 40% of national homeowners own their house free and clear.

The terms of the investor buyer fully paying off your home loan is negotiable, but the longer you can wait the more investor buyers that will be in the market to buy your Minnesota home

3-10 years is usually in the desired range of the agreed upon payoff balloon date to payoff your home.

Due to very high interest rates we can discuss an interest rate that is existing or the investor and you both agree on.

The top trusted investors prefer to buy on the highest level of ownership in title with the most rights.

let’s review the math again assuming rates are much higher today than the 2.5% from the past.

50% discount just because on interest rates alone.

many retail buyers and investors purchased homes with leverage and stretched the price that they could pay at a 2.5% interest rate. In a much higher interest rate environment when you sell your same house at a 8.8% rate you would have to come down 50% on price just to give them the same buying power. That’s not even including the deferred maintenance that accumulated over the years that you owned your house.

here is the math:

Housing payment, interest portion

Buying power

$3500 monthly payment

$885,805 house price

2.5% interest rate

$3500 monthly payment

$442,884 (50% less) house price

8.8% interest rates

# 3 Option

(Please note: before you even consider Option #3, it’s going to be much harder to get an investor to buy, so I’d only recommend option #3 if you are ABSOLUTELY certain without a doubt that option #1 and option #2 price and terms will NOT work for you, and start off offering zero down upfront on terms.)

#3 option Sell on terms (seller financing) at a average discounted price

(As a Minnesota Home Seller you will need to do most of the follow up as you will likely not be a top priority for an investor like you would be with option #1 and #2)

I’m telling you this in case you have been waiting for months for a call back from other companies.

Option #

3 A

With the #3 option…

zero down down (upfront money out of the investors pocket) is very attractive to an experienced investor buyer as the starting negotiation terms with them.

In addition to upfront money on your home with seller financing you will be negotiating the interest rate, payoff date (balloon payoff date 5-10 years preferred) and any underlying financing with your bank and the current amortization chart is all a negotiating factor. Whether your underlying bank has fixed or ARM financing is a factor for the investor buyer also.

Remember as the seller you are looking for relief from stress, you are looking for peace of mind, so that you can sleep at night.

This isn’t just about you getting a little of money upfront. The true relaxation comes from knowing that someone else is going to take over your payments, to protect your credit, equity and money from being destroyed If you were to miss any mortgage payments.

Subject-To Existing Financing

You Sell your property by what’s referred to as ‘subject to’ -that is where the investor buyer takes over your mortgage payments and gets the deed signed over (not for free and clear homes) and your underlying financing stays in place until your Minnesota home loan is paid off in full. The investor will inherit your interest rate and current amortization chart and schedule.

This could require an additional step and proof of the payments from the investor as to not delay your qualifying for your next home when it comes to your debt-to-income ratio.

The reality is most motivated sellers still choose it because they have bad credit anyways, and won’t matter to them for awhile.

the investor buyer will take over the payment on the property taxes and get the necessary insurance for coverage on the property.

#3 B

Sell on a wrap-around-mortgage

#3 C

Sell on a Minnesota contract for deed

#3 D

Sell on a lease option

The order in which the most experienced trusted knowledable investors who WILL actually close. prefer to buy your property in this order:

Option

#1

#2

#3 A

#3 B

#3 C

#3 D

Please note: Usually only experienced investor buyers understand #2, # 3A and #3B and some title companies may not even have experience its these options this is why you want to work closely with my limited local experienced and trusted investor associates.

Minnesota Owner financing often works best with all Minnesota home sellers that don’t need all equity, or their cash upfront, or their mn home loans paid off right away.

Also your mn home sold with owner financing will generally be in great or excellent condition and probably need less than $5000-$10,000 upfront for immediate problems such as: missed mortgage payments to stop foreclosure, fixup to make the home livable or in rent condition, past due property taxes, or liens owed at the time of closing at the title company.

In other words…Mn Owner finance offers receive the best price when immediate money upfront IS NOT needed by the investor

It’s your decision between offers:

Option #1

All cash = 50% of ARV

70% of ARV less repairs

Option #2

Full price = 0% interest $0 upfront free and clear home owner financing

Option #3 (least recommended)

Subject to, wrap around mortgage, contract for deed, and lease option which will be negotiated based on price and terms based on your investor buyer demand

I know at this stage I felt that I really had to decide how soon I needed to sell and at what price I was willing to sell at…

…I’m sure you are feeling similar right now, so I found that this is the final stage of invalidating all other options and narrowing it down to your ONE choice, where you feel good about your ONE choice, and it’s in full alignment with your future goals…

Right now…let’s answer some questions that you may be thinking of, or haven’t thought to ask yet…

remember to text me at the phone number below…

4. Product Aware

This step is about you comparing the different companies for your best solution and peace of mind and it’s my job today to help you narrow it down to only ONE choice by telling you why the experienced and trusted investors that I know are different than the new investors out there that you are likely to run into making me the ONLY choice today.

Because I work with experienced and trusted local Minneapolis investor buyers that I’ve known for a very long time, I don’t see local competition.

Here’s how I can be so confident about this…

Many other Minneapolis investor buyers that you’ll run into on your own are very inexperienced and want to just tie up your property under contract and aren’t the actual buyer for your property.

This will waste months and thousands of your hard-earned dollars.

Many of the other new inexperienced investor buyers that you’ll find on your own have many contingencies (clauses) in their purchase agreement, so that they can easily back out of the contract wity you later on your Minnesota house sale because they aren’t confident in what they are doing…

That’s not the case with my experienced and trusted local investor buyers that I know. This will save you from risking wasted months of sleepless nights, and thousands of your hard-earned dollars.

Many new inexperienced Local minneapolis investor buyers will sign a purchase agreement at one price and wait maybe a month, or right before your closing only to try to renegotiate the price and terms with you which is dishonest and frustrating for you.

My solid trusted experienced investor buyers won’t play games with your time or your money. They want to move quick just like you.

Many of those other inexperienced investor buyers don’t put up non-refundable earnest money, which makes it easier for them to back out of the purchase agreement later, but my experience trusted investor buyers that I know, have done this so many times that they know what to pay and how to close on time.

Many of the other inexperienced investor buyers, are straight out of a weekend seminar with only a few hours of education.

They won’t hesitate to experiment with your property, waste your time and waste your money and then back out later on, with my trusted investor buyers You’ll be working with an experienced professional.

Many of those other new inexperienced investor buyers print a 2-page contract that they just found off of some unknown website that may not even apply to Minnesota and federal laws.

I know trusted Minneapolis, Minnesota investors that use standard agreements that are easy to understand, and you can review to be Minnesota state approved.

Many new inexperienced investor buyers that you’ll find when researching are attempting to close their first or second deal, but my trusted investor buyers that I know and trust can share testimonials and stories with you about specific recent deals that they have closed with success with local home sellers just like you.

My investor buyer associates are able to talk specifics and even have addresses they’ve closed on to add credibility to your home selling experience.

My experienced trusted investor buyers will share recent positive testimonials if you’d prefer.

Some of my trusted investor buyers, as a bonus, can provide A+ ratings and reviews with BBB accredited info

My trusted and experienced investor buyers can provide proof of funds with the lenders that they have used on deals in this past year

An investor buyer wants to close the deal, so if they need to pay standard closing costs, and allow you to choose the closing date and the date that you move out, so that you receive complete flexibility the investor buyers are usually open to that.

As a Minneapolis or St.Paul area local home seller, you can ask for a higher cash price or more money upfront with owner financing, but just keep in mind that your local investor pool of buyers will shrink a lot with the possibility of delaying your sale today because of months of negotiating back and forth, which could happen with option #3

There is a lot negotiating involved to find alignment between the investor buyer and you.

I’ve felt at this stage before, as you are likely feeling right now and what I know is that you need to make a decision to move forward even if it’s just a first text to me at my private phone number below.

5. Most Aware

By now you see that you have enough information to choose me as the obvious ONE option, and you should now have peace of mind and clarity to be able to make that your final decision.

You want options

You want liquidity

You want to feel joy, appreciation, empowerment, freedom, love, passion, enthusiasm, eagerness, happiness, positive expectations, positive beliefs, optimism, hopefulness, contentment

you want to take amazing vacations again in warm weather near the ocean and stay at 5 star resorts and eat delicious food and have a comfy night’s sleep.

you no longer want to worry

you want peace of mind

you want a clear mind

you want to focus on being healthy

you want to focus on your families health

you want to tell a positive story to all of your friends

You want to dream again

You want to be proud of yourself again

you want your family and friends to look up to you again

You want to take pride and look forward to each day again

you want to be excited to jump out of bed

you want to be able to have financial freedom or have the option to work part-time and make Amazing memories with family and friends whenever you want

You want to make peace with your past

you want to be able to buy a new car

you want to treat yourself to the best things in life

you want to imagine an amazing future again

Together we can close the gap and bridge the gap from your current negative emotions, where your house, controls your thinking daily right now to selling your house and allowing your emotions to be amazing allowing you to feel free towards your amazing future.

As a bonus, we will guide you with a plan and options as to the right timing for your next place to live.

My investor buyers are usually busy buying Minnesota homes just like yours, negotiating prices, terms and looking at homes in person throughout each week, so before texting me, you must be motivated, serious, reply back promptly the same day, and answer your phone when they call.

The top investors are too busy to chase you if you aren’t serious about following up.

I’ve felt where you are right now, standing in your shoes, and what you are feeling, and you know what I found is that by reaching out, by just text, at least helps start the conversation and start momentum towards alignment, clarity and a peace of mind solution.

Texting me and starting a conversation has no risk to you

It’s a great way to dip your toe in and get started in the process of selling your home.

Take a moment right now and TEXT me with your thoughts on how the above article relates to your housing situation.

Take action and start the process today.

It’s so easy, that anybody with any house situation with a phone can text and talk by phone with even just one starter question.

You DON’T have to be an expert

You DON’T have to understand it all

Remember that you are simply just starting the conversation, so that you have time to process your thoughts and emotions later just start the conversation to gain some new perspectives.

If you aren’t ready to sell right now then you can go ahead and try to do it on your own, which I wouldn’t recommend, attempting it on your own over a few months…

…or you can reach out to me today and ask for my help…

Remember that you can get a big check or pile of cash for a quick sale on your home and it can be done in days…

You have 3 options right now:

1. Do Nothing

2. Do it all yourself

3. Let me help you

here is my private cell phone # below…

After reading the above, if you are now motivated to work ONLY with MY investor associates please take a moment to Text Me

Before you text me, imagine that I’m getting 20 texts per day from other home owners just like you also motivated to sell. I want you to be at the top of the pile of competition of other local home sellers…

…and how do you accomplish this?

when you text me your full perspective of your house situation, based on what you learned by reading through the article above.

For example, If your text to me ONLY reads…

Hey Ron, I’m just reaching about that article….

that doesn’t help me, imagine how many articles I have, and how much back and forth we must text just to understand where you are at…

Remember for you to come across as serious, realize that I’m aligning you with the right investor, so help me help you, get top priority with that investor buyer, and go straight to the top of their pile over the other 15 competing home sellers that reached out to them all trying to sell this week. Make them prioritize their time today with YOU.

I’m here to increase the probability of a conversion and house sale for you, to be effective for both of our benefits, both of our solutions.

Text me first, because I won’t recognize your phone # if you call, there are too many unrecognizable spam and robocalls, and I DO NOT use voicemail, so please ONLY TEXT me FIRST.

The investor buyer will call you once I get enough information and it aligns with their proven qualifying buying criteria.

Let’s take a moment to review the Seth Godin quote one more time from above.

By now, you’ve had time to process your emotions on believing what I’ve told you.

You now know the answer to

Should I sell my MN house now?

I’ve gone through the math and the your thinking showing you exactly how it works.

I’m assuming that you already have shown this article to your friends for a trusted perspective because often you’ll believe them.

That leaves just YOU reading this

You ALWAYS believe what you tell yourself

By now you know that selling your home is in alignment with your future goals…

I know you just read a lot of information…

If, for any reason, you are still hesitating or resisting texting me, please practice re-reading this entire article a few times because you will become more and more comfortable the more times you re-read it. I want you to be comfortable through the entire process.

We make it easy

No listing, no commission options

Pick Your closing date option

Top dollar option

sell as-is condition

Here is a video of the emotional journey of selling a house https://youtu.be/lS5DpSQaGpg

Watch this video about the emotions of the home buying journey and see how you relate to it https://youtu.be/26ivyNaySEE

You will soon have peace of mind with your house.

You will soon have closure with your house.

You will soon be able to sleep at night.

You will soon be able to move on with your life.

Your heart will soon be at peace.

You will soon get back control.

You will soon get back your freedom.

You will soon get back your free time.

So my cell phone is either in my hand, or my pocket right now, my # is below, and the ONLY thing between this line of text that you are currently reading right now and MY cell phone number is

You saying and believing out loud

“Ron I’m ready, I’ve decided it’s time, I must sell my house quickly As-Is for a fast cash offer!”

Take Inspired Action…It’s Your Move

Don’t waste any more time letting your property drain your energy, personal health, retirement or relationship with yourself

It’s time to

Move on

And let go of

Your attachment to this house

Isn’t it time for relief from the pain?

text me right now

(612) 434-5606

Ron Orr

Real Estate Investor

*please take a moment to subscribe and follow me on my Facebook below and save this page to reference later

What makes a property owner motivated?

Can’t afford payments

Can’t afford falling prices

No money to refinance

Inflation used up their savings

Property taxes and insurance skyrocketed

ARM payment escalated

Divorce or seperation, custody

Failed investor

Speculation failed

Death in family

Probate

Inheritance

Move out of state for family

Job out of state

Deliquent HOA fees

HOA fees went up too fast

No money to fixup or finish

Unemployed, forex, layoff

Unemployment or stimulus ran out

Renter isn’t paying

Renter caused a lot of damage

Burnt out landlord

Deferred maintenance

Can’t afford utilities

Doesn’t want to be a landlord

Builder needs to move inventory fast

Expired listing

Vacant

Ready to downsize

Can’t afford housing crash

Retirement

Major Health issues

Big medical bills collections

Massive credit card debt

Behind on payments

In foreclosure or redemption period

Loan mod won’t work

Upside down in short sale situation

Walked away from the property

Can’t manage out of state

Major fire damage

Major water damage

Major mold damage

Can’t afford unexpected city fees

Estate sale

Depreciation recapture on taxes

1031 exchange deadline

Delinquent Liens

Delinquent levies

Mechanics liens

Delinquent personal taxes

Condemned from city

Code enforcement violation

Failed Airbnb cash flow

City won’t allow Airbnb

Negative cash flow monthly

Possible tear down

Major siding, roofing & window expenses

No Insurance to fixup

Full of junk and trash

Owe people money

Capital call or margin call

Couldn’t sell FSBO

Free and clear need payments

Too young for reverse mortgage

Out of money, time, energy & options

Crime in local area

Eviction moratorium

Can’t afford time or money on evictions

No equity left

Kids left house, too much house

Expecting a baby

Recent marriage

Agent couldn’t sell or find buyers

Mortgage person couldn’t get approval

Major storm damage

Zoning issue

Environmental issue

Low demand location

Railroad Track or power lines

Calculated ARV or fixup wrong

Contractors left with their money

Can’t split lot

Absentee owners

Disagreement with siblings

Balloon mortgage due

They were defrauded

They committed a crime

Bad economy

Wholesaler left them stuck

Bank wants keys or REO

Redemption period deadline

Non working utilities

Lost a lot in crypto

Lost a lot in stocks

Lost a lot in 401k

Lost a lot in pension

Paying for family assisted living

Paying for family nursing home

Paying for family group home

Parents or family has health expenses

Cars being repossessed

Landscaping & curb appeal too expensive

Rental is out of local area

Too busy with life

Too busy to chase rents

Too busy to manage

Doesn’t want lots of showings

Hard to show with tenants and condition

Not selling on MLS

Not financeable

Non-conforming bedroom

Poor manager operator

Investor wants money out