Sell my MN home as-is fast cash before the government quits subsidizing the economy

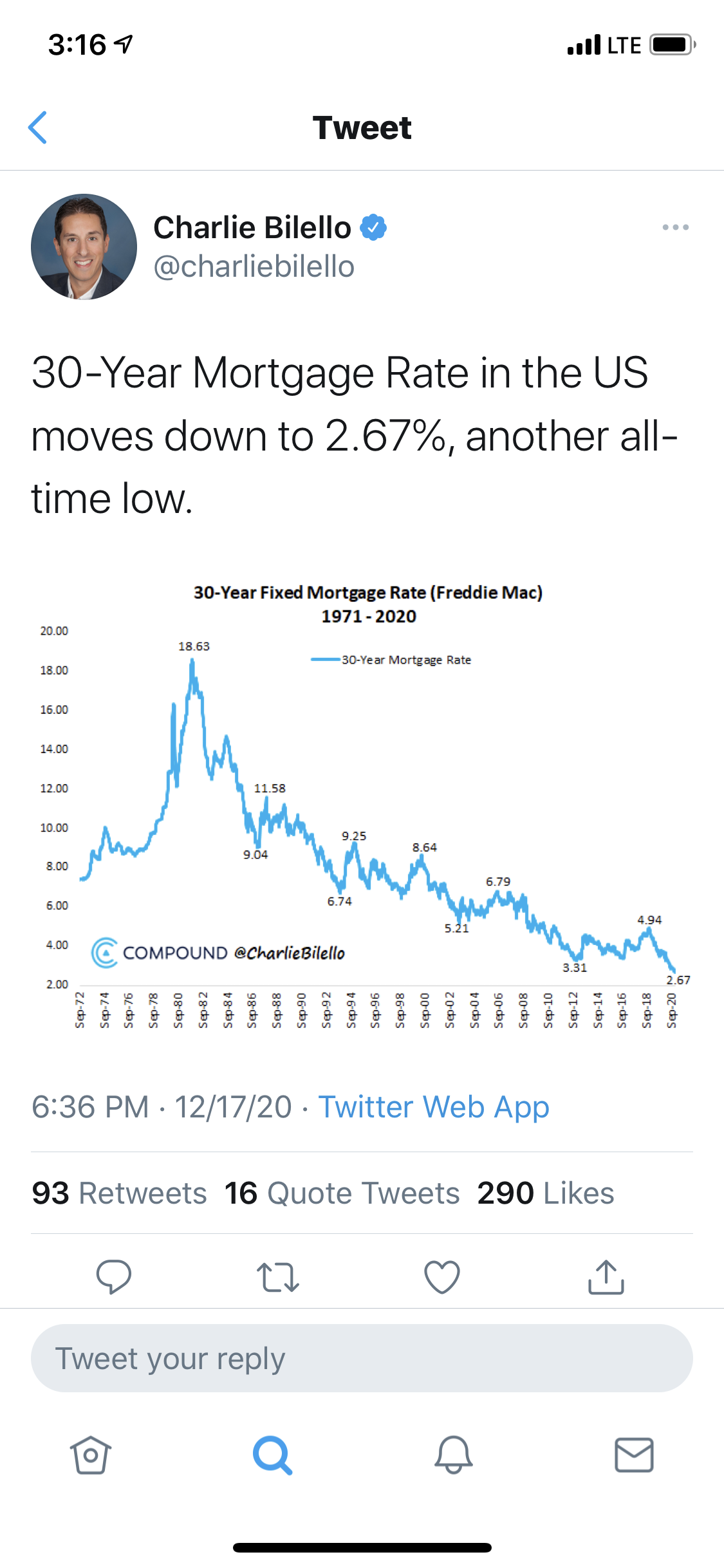

Very Low interest rates for housing

As you can see these U.S. rates are very low, and if you get a fixed interest rate that’s great. They are low because the fed rate has been near zero for 12 years. It did get up to 2% for a short period of time in recent years, but because of the debt and the need for demand they had to lower the rates more. These lower rates are going to create challenges for the banks with squeezed arbitrage for profits.

When it comes to housing we know that home buyers buy for the monthly payment affordability, so think of the the hogh house prices as the inverse of the super low rates that have gone up to balance out supply and demand. Many will say due to the last crash the last 10 years didn’t see as much new construction housing as before so we are low in inventory.

Many people aren’t selling for many reasons:

because they want to age in place, they may be concerned of the increased foot traffic due to covid-19, or concerns that because houses sell in only 24-48 hours Due to low inventory that they could be found to be homeless if they sell right away trying to compete with multiple offers in the current real estate enovronment.

Some say the fed won’t raise rates until after 2023-2025. Many home buyers love this news, and those looking to refi their mortgage. But it’s hurting those with retirement fixed income who get low returns and speculate with pensions, stocks, bonds, bitcoin and more.

Also many say that the interest rates need to remain low because of all of the debt would blow up with delinquencies including the national debt.

Also mortgage brokers are making big bucks off the Mortgage rates going down more and more each month with the refi’s.

How often as a homeowner have you lived off the price appreciation and cash out refi’s or the lower interest rates only to keep increasing your principle balance every year that you refi with closing costs and fees. Also you keep restarting your amortization chart as well every time you refinance.

Home prices will likely correct or crash at some point so be prepared for this, where the deflationary economy brings out the cash buyers who will want to buy cheap and especially if the homes have deferred maintenance.

Higher real estate commissions and higher demand

The buyer lines are lined up with such low inventory for years now. The low rates and cheap monthly payments. We are back up to the maximum mortgage brokers and agents that were in the business back before the crash of 2008 as there is big money and big demand. Offers are being written up left and right.

Real estate agents, mortgage brokers and even title people are benefiting huge from all of this high demand and homes which have seen prices nearly double in the last 10 years, much of it from the years of 2015-2020.

With the low inventory and falling interest rates the prices of houses don’t seem to be slowing down in increased pricing and appreciation as buyers are willing to compete and outbid each other by 7-10% on homes often. It’s very competitive out there in the housing environment.

The fed is of course subsidizing, manipulating, suppressing these low interest rates and has been since 2008 when the crash never fully crashed due to all of the bailouts.

As an example, If real estate house prices were to go down 40% in a housing crash, demand would likely be cut in half, many months between closings, and real estate commissions would go down 40% since house prices would go down 40%. Some households have husband and wife each with a real estate related job and that would be a double whammy. Yes the low interest rates are keeping real estate strong for now. Will the rates rose to 5-6% again sometime in the near future?

The interest rates should be far higher to compensate for risk, but we can get into why they aren’t below more in detail with the mortgage back securities.

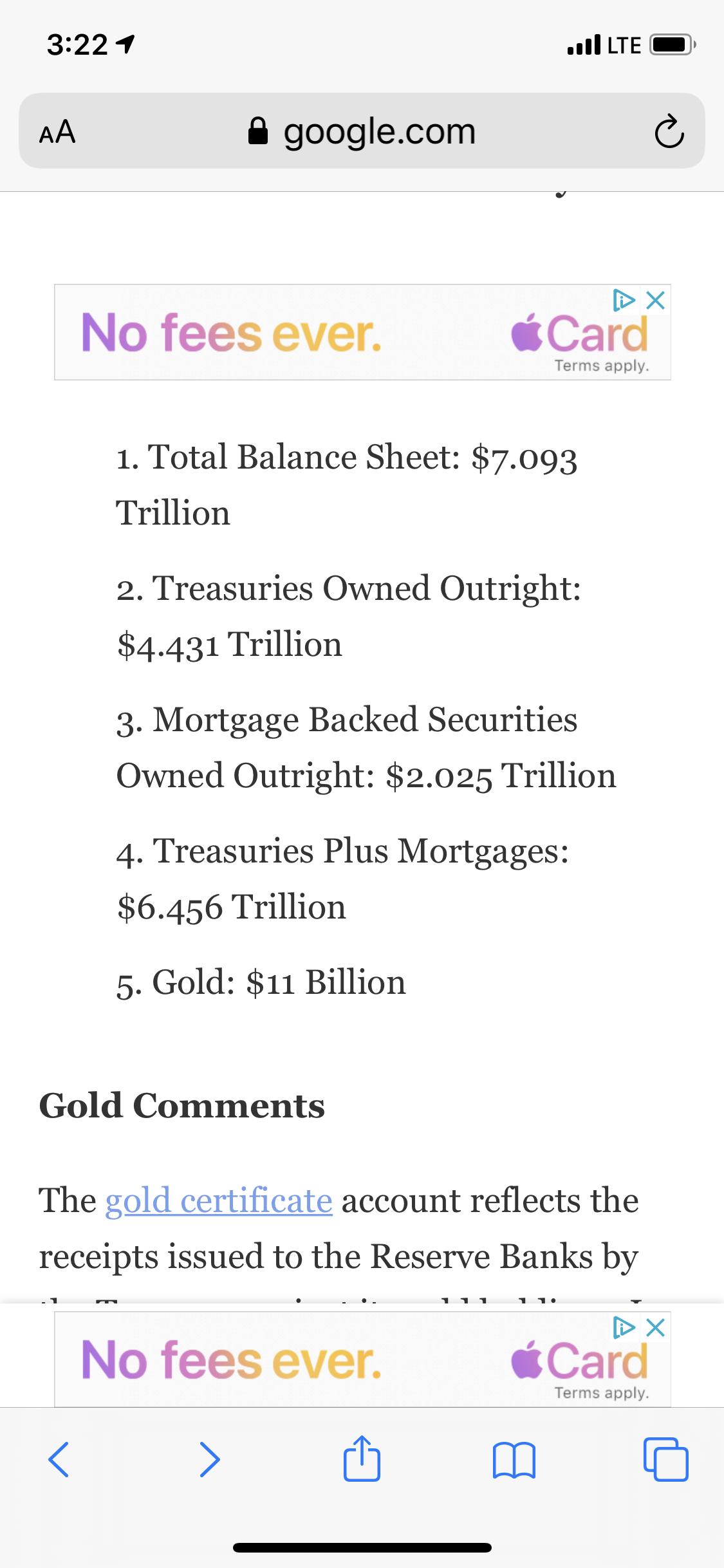

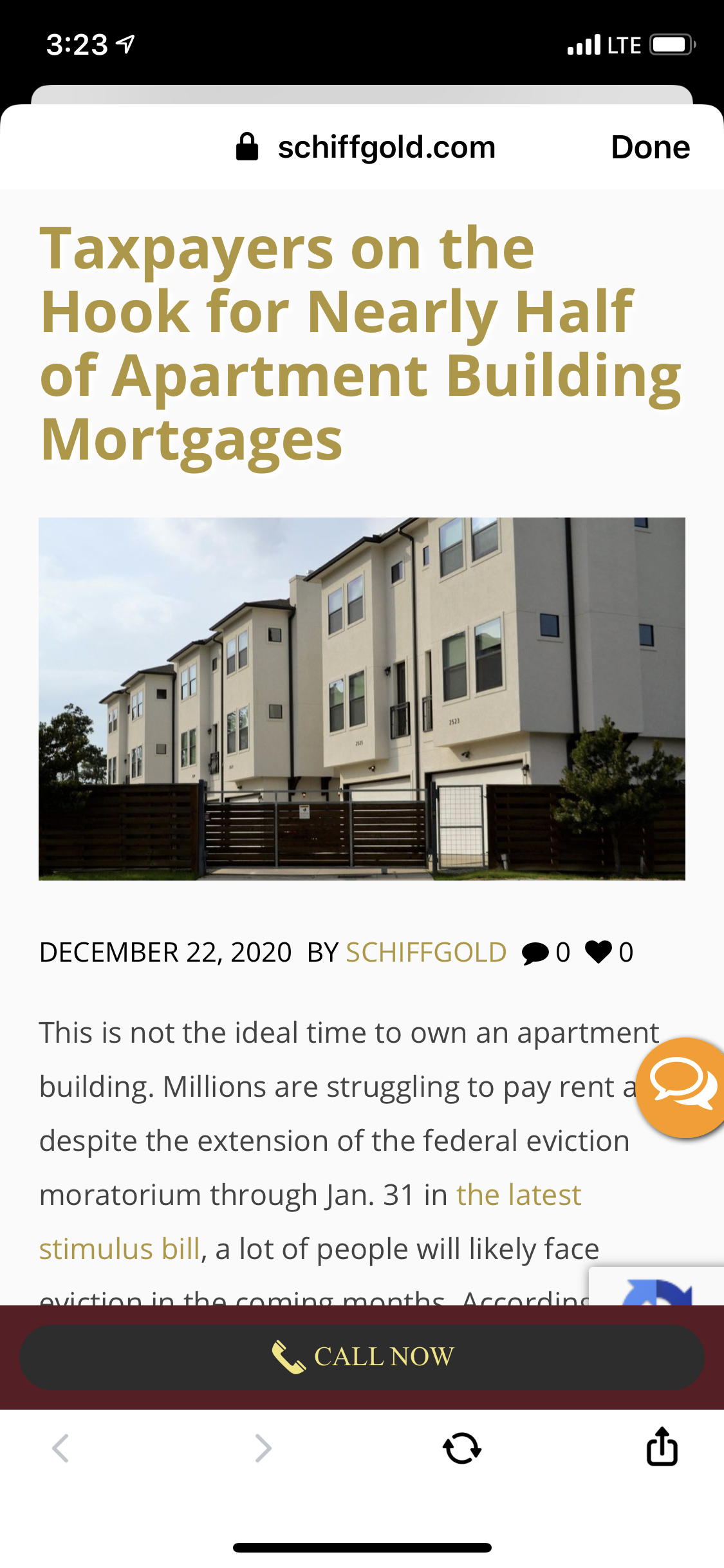

Fed owns $2+ trillion in mortgage back securities GSE Fannie Mae, Freddie Mac, Ginnie Mae

As we know the real estate agents keep selling homes because the mortgage brokers keep getting them pre-approved buyers based on low down payments and average credit scores, very easy lending.

The mortgage brokers have warehouse lines of credit and just recycle money for commissions, as they sell off their loans. Some banks keep portfolio loans.

This Money to the mortgage brokers is coming from banks and securitizing loans into mortgage back securities at a rate the investors would pay for them for returns on their invested money. At least that’s how it use to work….

Now, the fed is buying up much of the mortgage back securities, (over $2 trillion) and rapidly climbing. This is what’s keeping real estate still humming along for now.

The government has its hands in backstopping and insuring everything else GSE, Fannie Mae, Freddie Mac, Ginnie Mae, that includes defaults, foreclosures, forebearance, etc. So the risk is about to be shifted to the tax payers when this all crashes, as the tax payers are taking on the real risk.

Minnesota Forebearance and foreclosures

Foreclosures haven’t started to really escalate yet because some people have been renewing their forebearance for up to 1 year through March of 2021. Watch these Individual counties spike in foreclosures as time goes on and landlords can’t make payments due to uncollected rents and the unemployed home owners and renters just hang on any longer.

In addition there are a ton of business closures, these businesses should continue to close, there are burned down buildings, retail and restaurants going out of business, PPP loans being forgiven, insurance bailouts, and years of upcoming property taxes that the cities won’t be able to collect now that the landscape shows so many fewer businesses as well as those who have fled the city to the suburbs for safety.

The cities will see a huge shortfall in property taxes in the coming years and the remaining businesses and housing sector should see some very high property taxes to make up for it. Lots of uncertainty out there in all areas.

Minnesota Eviction Moratorium, late and unpaid rents

We are now seeing an extension of the eviction moratorium through the end of January 31st by FHFA and it may still keep getting delayed.

This is putting a huge strain on landlords who will have some tenants not paying for nearly 12 months. The landlords still have to pay property taxes, insurance, their mortgage payments, often utilities and maintenance on the buildings.

Check out the new proposed bill with 12-15 months rental assistance the government has no end to the amount they will keep subsidizing and all of the printing of money.

What about landlords mortgages, and bailing out insurance companies and utility companies and contractors who don’t get paid for maintenance.

What if government bails out everyone and we have another $25 trillion added to the national debt. There’s still businesses, airlines, commercial real estate, and so many more to bail out.

December 6th 2020 was showing 25% of rents were late or haven’t been received by a big rental tracking company by the largest multi-unit organizations. Often more of that rent comes in later in the month. They were not tracking mom and pop landlords I’m told.

The government has their hands in rent control in some big cities. As you can see above the government directly controls or indirectly almost everything besides how you sell your home, or what price you sell for, so there is still a little freedom left.

Minnesota Unemployment, stimulus, bonus money, food stamps, foreign countries

Many renters amd consumers got into a lot of debt and maxed out credit cards over the last 10+ years. Now many depend on unemployment to be paid for a year or two, but with all of this easy money why would any look for work?

Many are becoming dependent on the government into the future.

Stimulus money keep coming in every few months from the government, bonus money on top of the unemployment, food stamps keep growing and food banks keep growing.

Foreign countries are now getting billions of dollars of aid from the US in the December 2020 stimulus bill. Socialism is here in America and taxes should be expected to go way up in the very near future.

As you can see from above I once read last year that real estate is 18% of GDP and it’s clear that the government is subsidizing everything.

My post yesterday showed you how 40% of total GDP is coming from all of this money printed by the fed in the article asking if you are ready for inflation.

Our future of government dependency and socialism is looking more certain every single day. With so much uncertainty into the future instead of speculating and gambling with your retirement like most, hoping pension money or social security money will be there in 5-10 years, why not buy cash flowing Minnesota real estate where you rent out rooms, house hack, utilize Airbnb, have a duplex, triplex, or 4 unit building that you live in with only 3.5% down payment needed upfront.

Hedge against the inflation that we are seeing that’s getting worse every single day with multiple streams of income.

I’ve been around real estate since 1998, investing since 2002, renting room back since 2001. I’ve been an agent and broker in the past and even a short period of time with a mortgage license.

I know real estate investors that I can introduce you to, to help you hedge against America’s reckless spending into the future so that you have more certainty.

My goal is for you to reach out and invest for the purpose of getting a good enough price and have a good strategy of a home that you could live in with the universe tax exclusion, or if you like the home that you live in that buy an investment home that provides you great cash flow, low monthly housing expenses, so that you can keep you and your family healthy for the future.

Renting out units or rooms can provide you extra income when unemployment skyrockets in the future. Also an extra room in your house or multi-unit to use as your home office if you continue to work remote from home for years or that’s the new normal.

Just think ahead for your lifestyle. The extra income is needed for your families mental and physical help. You don’t want your family to be stressed out, it’s bad on their mental health.

Meditate or do any great daily habits that you can, so that you can have a healthy future for your family.

Waiting for the next stimulus check or unemployment money is not a dependable consistent future. If you just plan on consuming and living off the government than this article is not right for you. This article is for those who want to invest in their future for peace of mind.

I want to see you succeed and this information is not meant as tax or investment advice just information for you to base some decisions on for your future. I want you to see the big picture of what’s really going on in the US economy.

My contact information to text me is at the end of the articles for buying and selling with the above links that you can click to read right now.

If this sounds like you, click here

“I’m ready, I’ve decided it’s time to sell my mn home as-is, fast cash offer!”

To get more Content on this topic take a moment to click and subscribe to my social media channels below…