Sell my MN home as-is fast for cash before painful inflation

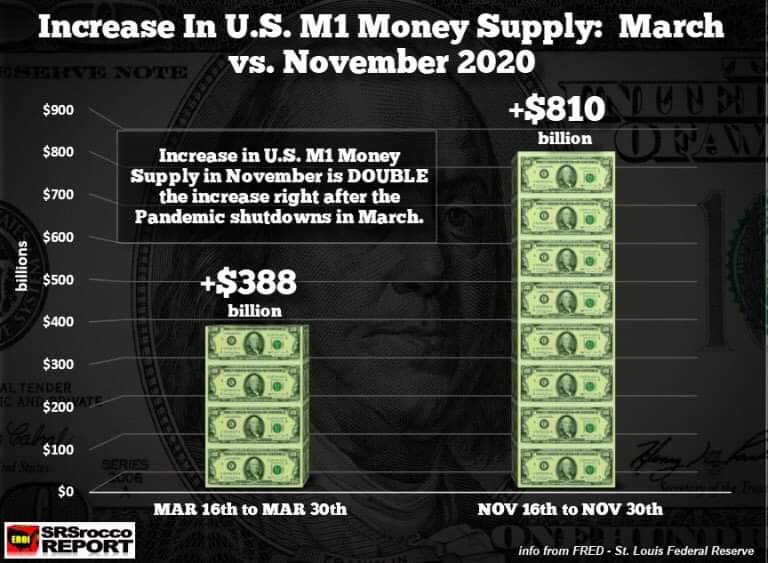

Based on a lot of the images below I want you to realize that the United States has inflation now and its only getting worse. The amount of money being printed at the end of November in 2020 is staggering.

We will get into those amounts below. Life comes down to supply and demand and when you print this large of a supply of US dollars You have more supply than demand and too much supply facing too few goods so you end up with inflation.

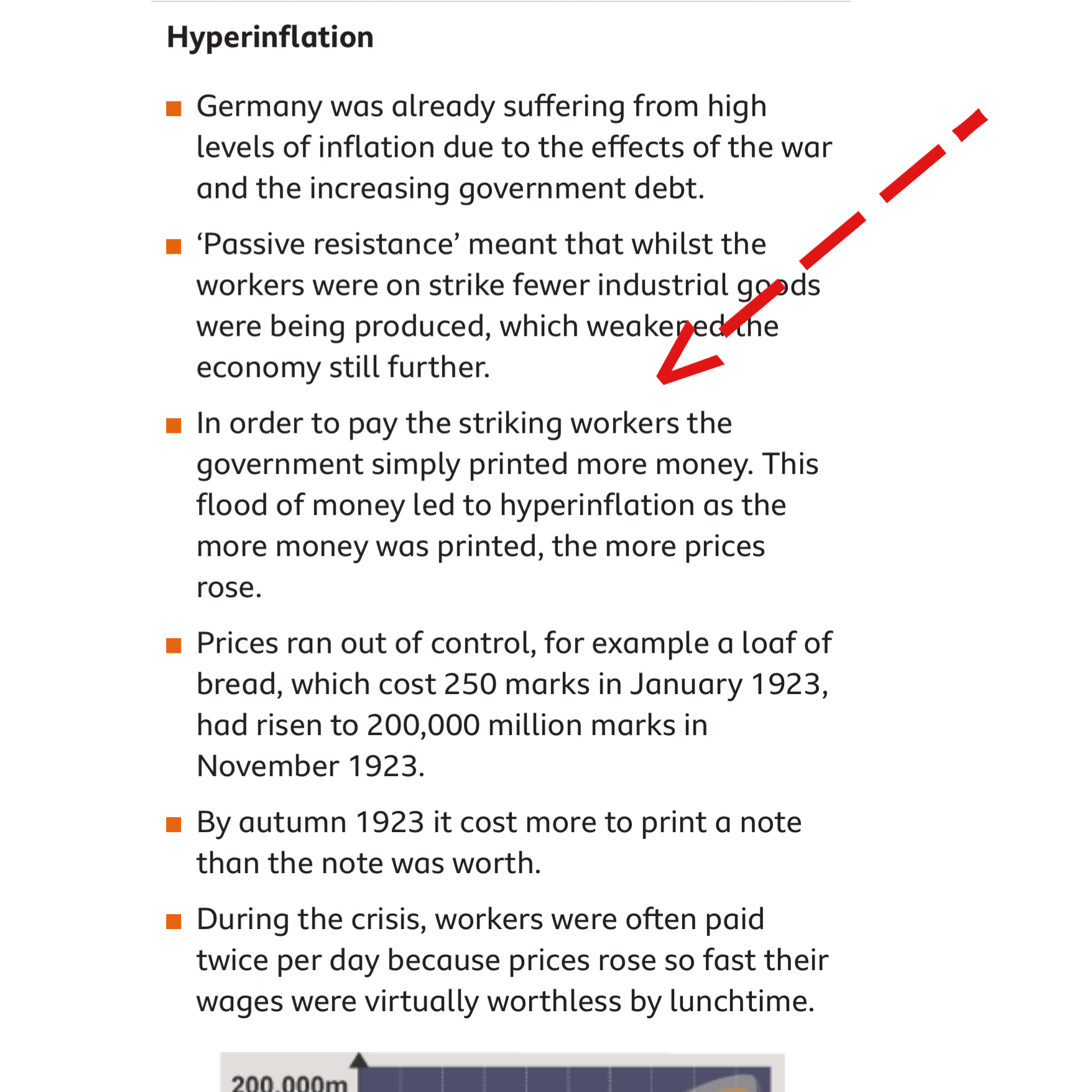

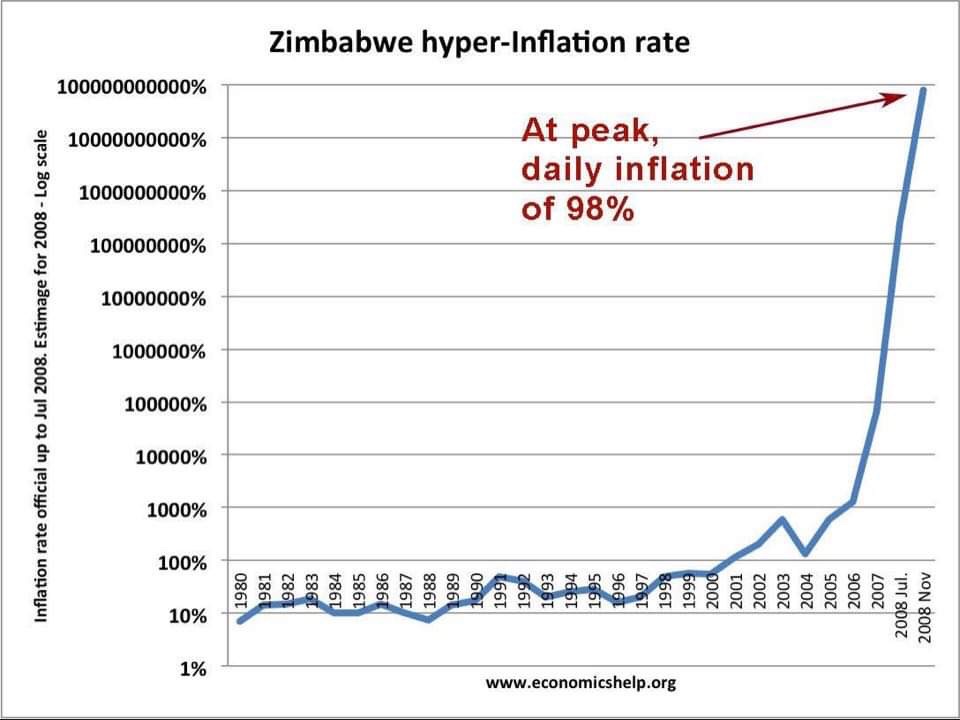

The big fear is that we get hyperinflation like in Germany in the 1920s. I will show you an image of what that looks like below if you keep reading.

There is a fear with many of a deflationary crash at some point, but for now we are seeing assets inflated because the money has to flow somewhere.

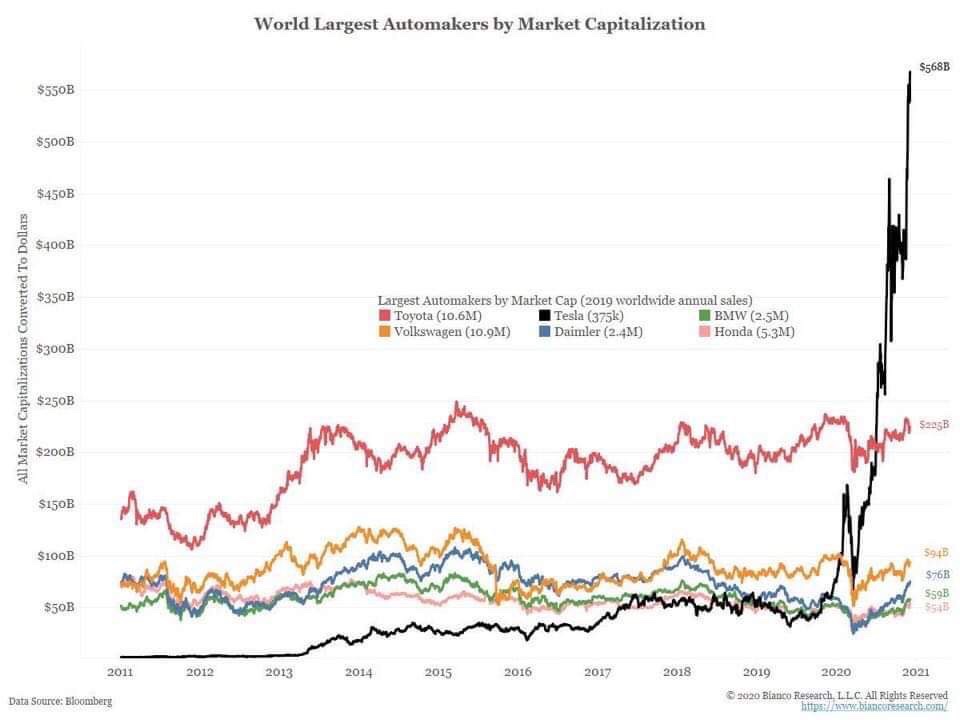

The money is being printed in the trillions for wall street so it’s ending up in stocks and bonds by the wealthiest 10%.

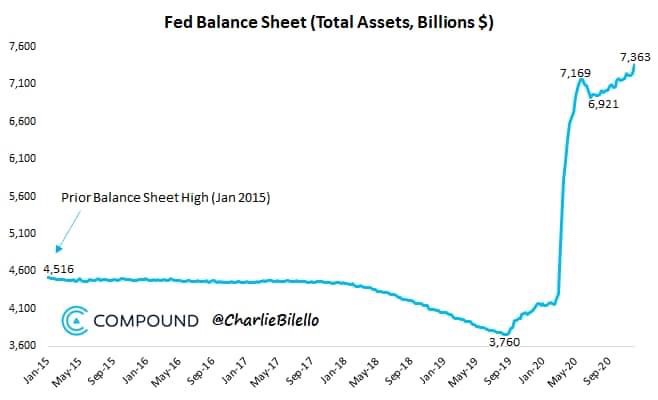

Stocks have been going up in parallel with the amount of money that the fed has been printing, if you look at it on a chart.

Here is an excellent article explaining the printing of M1 money supply and how it’s accelerated since March.

https://www.zerohedge.com/markets/next-dollar-problem-has-just-arrived

We had $880 billion printed towards the end of November of 2020. To put that into perspective many people feel gold and silver are the only real stores of value, currency and money when it comes down to it over generations.

We know it costs a lot of money and energy to mine these precious metals, and we know that they are rare, so check this stat out…

“Do you know how much $810 billion equals? That turns out to be four years of global gold mine supply totaling 440 million or 40 years of global silver mine supply of 32 billion oz.”

Pretty crazy right?

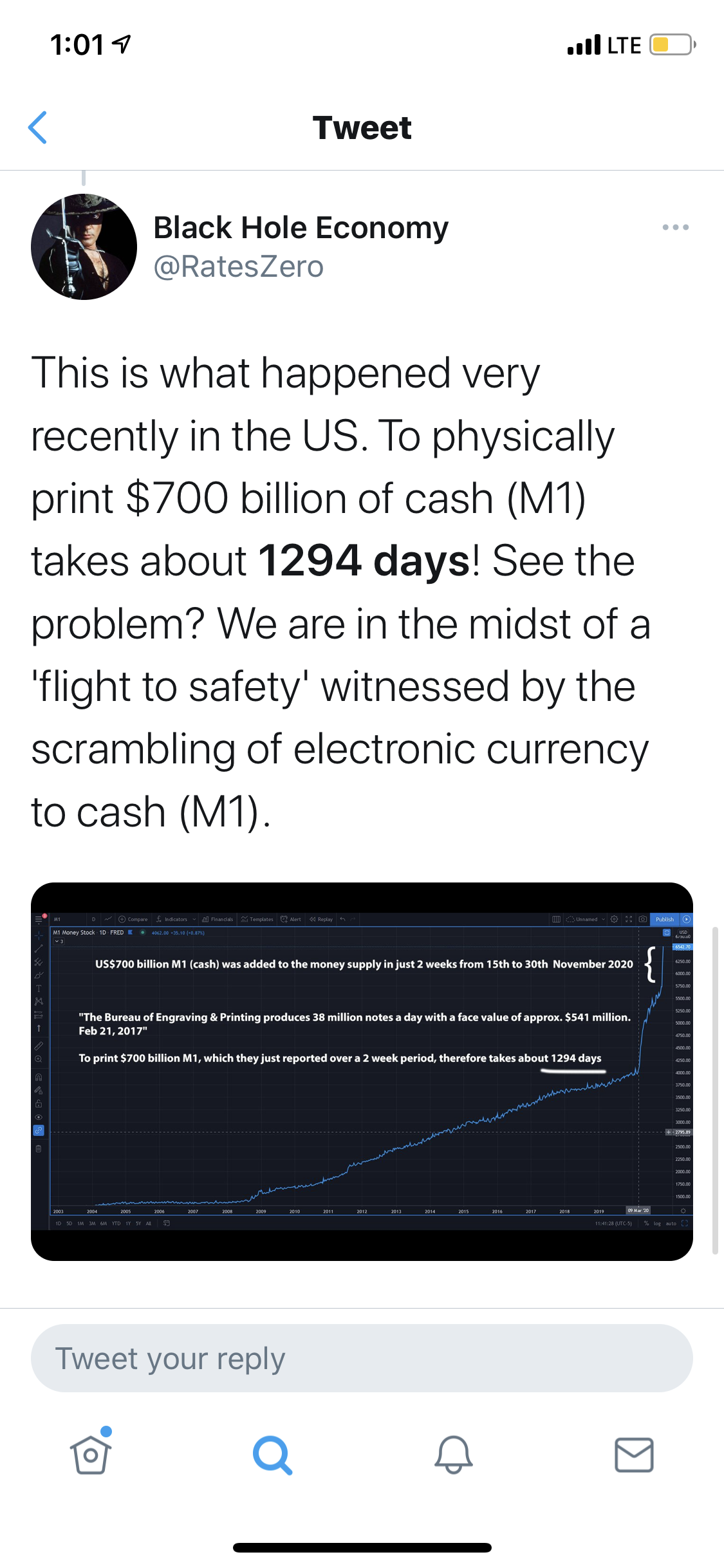

When the market starts to crash or people have a flight to safety and a bank run for US dollars, we don’t have them because they are electronic. So let’s say that people really wanted $880 billion right away. Check out how long that would take physically…

That’s about 4 years to print less money than that. That’s why when we have a real liquidity crisis it’s a real problem. When people need to sell and liquidate it causes a liquidity mismatch.

You see this with gated hedge funds where people have to wait 6 months to withdrawl funds.

Well check out the image below in this post about rules and limits on how often you can withdrawl money from your savings account, so there aren’t bank runs. Because remember the banks don’t have the physical cash, it’s fractional banking.

Here is a tweet that explains this

Withdrawl Money from your savings account

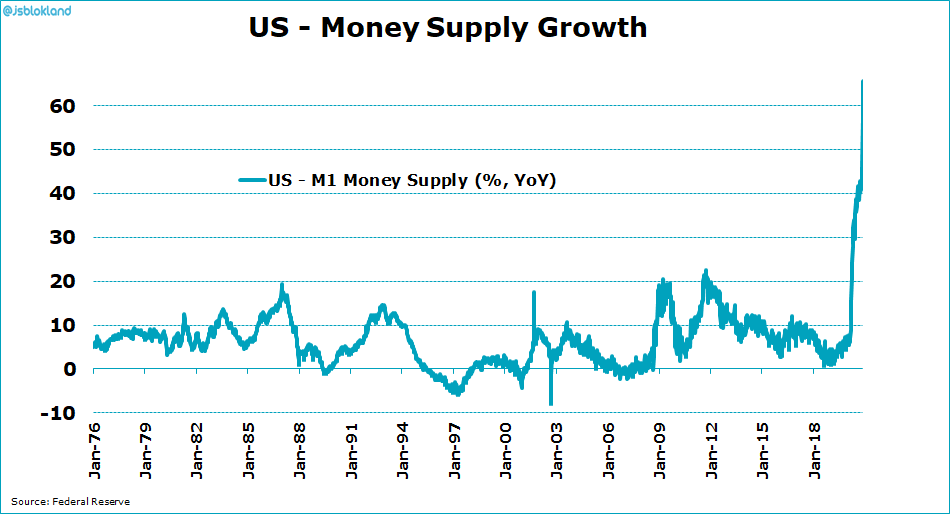

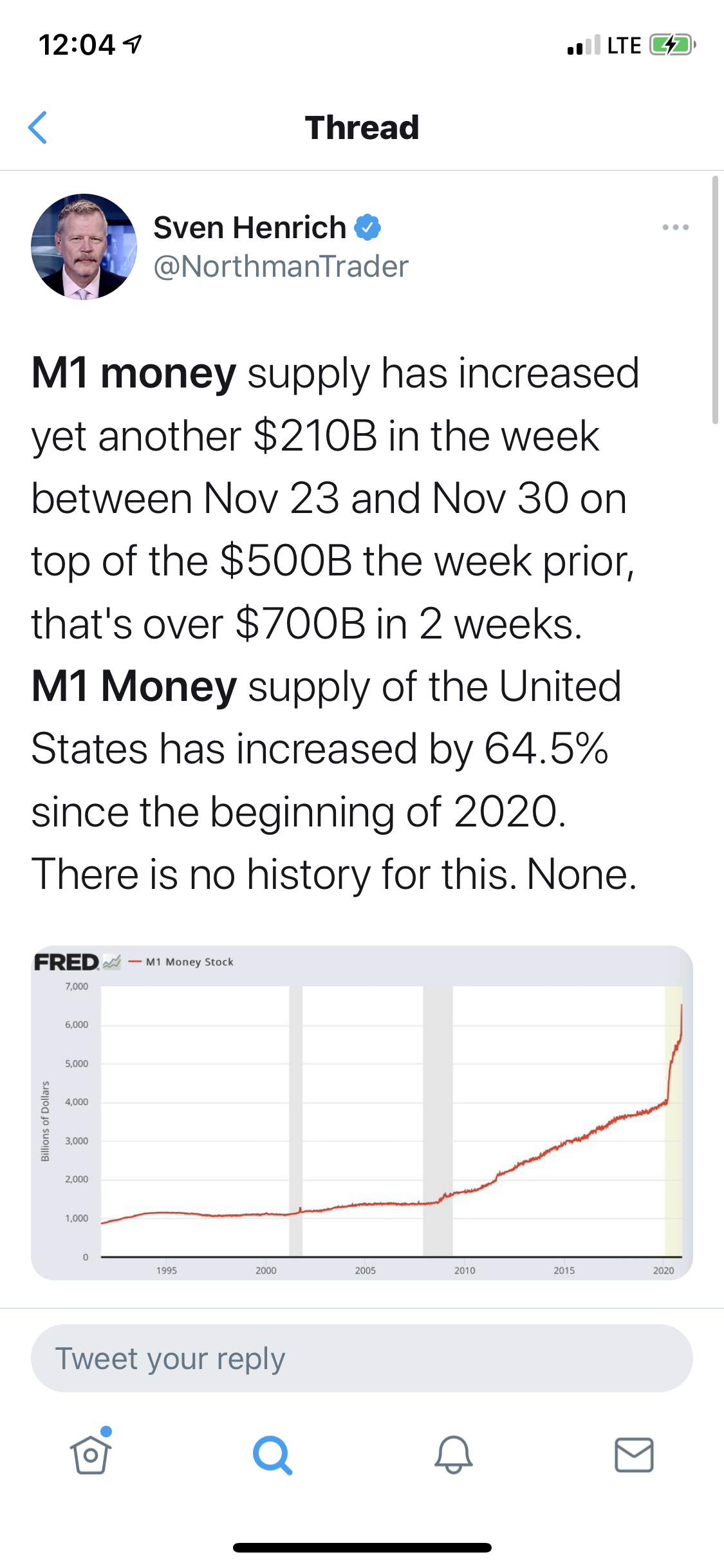

Here is another chart that demonstrates that m1 money printing has started to go straight up due to the bailouts because of the liquidity and insolvency crisis. It can’t keep up at this pace for long until US dollars become near worthless.

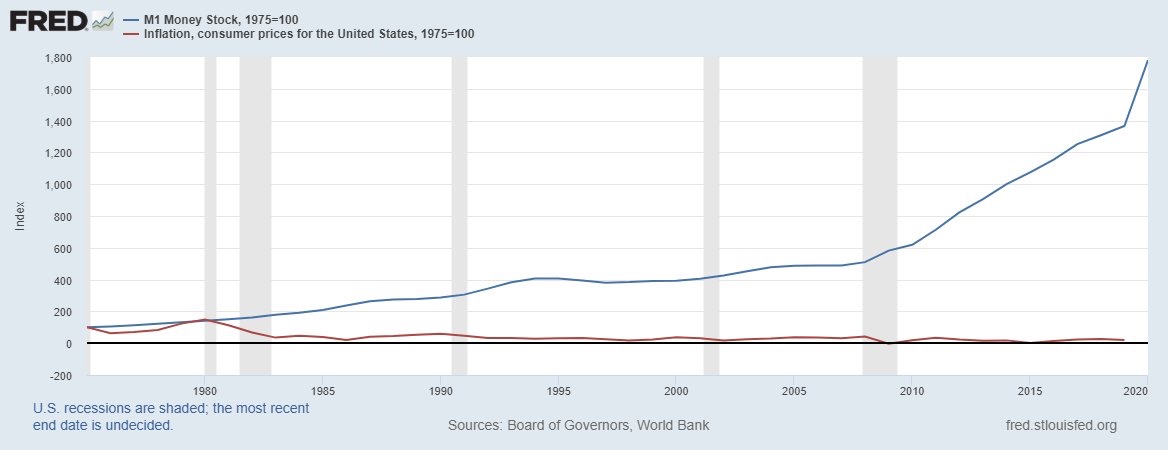

Here is another chart to see it over a long period of time you can see how it’s broken up at a very fast trajectory.

You don’t want to see hyperinflation

Check out how quickly money became worthless needing to get paid twice in the same day.

Check out how much the loaf of bread went up in months. They couldn’t print money fast enough and you would pay for simple items with wheelbarrows of cash.

One guy on twitter with great updates is Sven, he’s always talking about debt-to-GDP and more recently the M1 money supply and the acceleration of the printing of it. That 64.5% figure of all money printed is mind blowing to even comprehend how out of control the wording has gotten. People are waiting for the collapse of the US dollar.

So where does a lot of this money go, well a lot of it is going to the stock Tesla, is up over 800% on the year, and as you can see from the chart it’s almost straight up like Elon’s rockets. This can’t keep accelerating with new money at this speed most think.

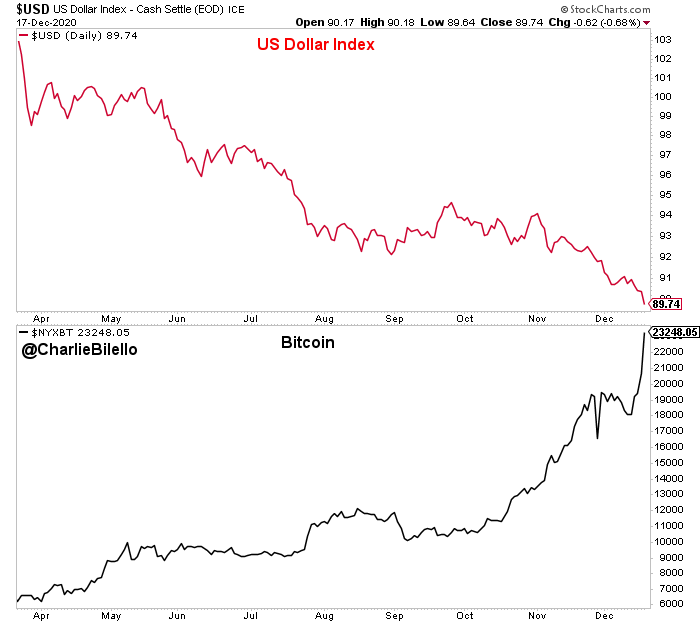

Other money is going into bitcoin and that’s why we saw it go from $10k to $25k in about the last two months. People are looking for a hedge due to how quickly money is being inflated from the supply.

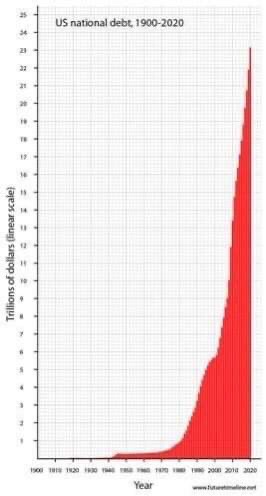

Look at how out of control our national debt has become. Could this go much more straight up. With unfunded liabilities by the US govt, many say it’s 10x this size. This chart tells a story doesn’t it?

In recent years you e heard about Venezuela and Zimbabwe currency inflating out of control. Look at how fast it was. 98% daily inflation, it became essentially worthless. You can buy $100 trillion bills on eBay for hardly any lonely, go look.

Here is that chart from earlier where I showed you the big increase in printing in November, it’s accelerating and anyone with US dollars and a retirement to think about should be very worried.

Here’s another perspective and chart to show you the trillions on the fed balance sheet and what a straight line it’s taken as a trajectory just recently to show how much the fed has lost control. What will it look Ike after December? What about at the end of 2021?

Remember a lot of people’s retirements, pensions, fear of no social security are at stake and with near zero returns with bonds and CD at the banks, people are chasing yields just trying to get any returns right now.

This is why a lot of people are willing to bet on the future of bitcoin. I’ll show you in future posts how just a small select few own most of the bitcoin and when they want to sell they can make the price homdien a lot.

You can see below that people are seeing bitcoin as a hedge to the US dollar index devaluing the dollar, on the opposite end more money is gong into bitcoin as the inverse. That’s not a coincidence. People see it as a hedge to protect themselves from their retirement savings in their lifetime being eroded away.

This next part I’ve been just learning from the last few days amd it appears that a lot of the m2 numbers aren’t going up while m1 numbers are.

Think of m1 like demand deposit checking account liquidity where money goes in and out a lot and m2 more like savings where people hold onto it longer and it’s less liquid.

We just saw the biggest love ever this past week. Many think it’s because money is moving to checking for liquidity. This could be to pay extra bills, losses or they think some restrictions are coming to savings on frayed withdrawals.

This image is telling you about the liquidity crisis that we think is happening now from this M2 to M1 amd how the fed needs to keep printing money anc the liquidity, so companies can stay in business.

People and businesses are addicted to credit. What’s he’s saying below is that we will see a insolvency crisis where a lot of zombie companies can’t even pay the interest on their loans and they keep refi just to stay in business, zombie companies aren’t profitable. As many as 10-12% of companies in the world I live heard are zombie companies, some claim even more.

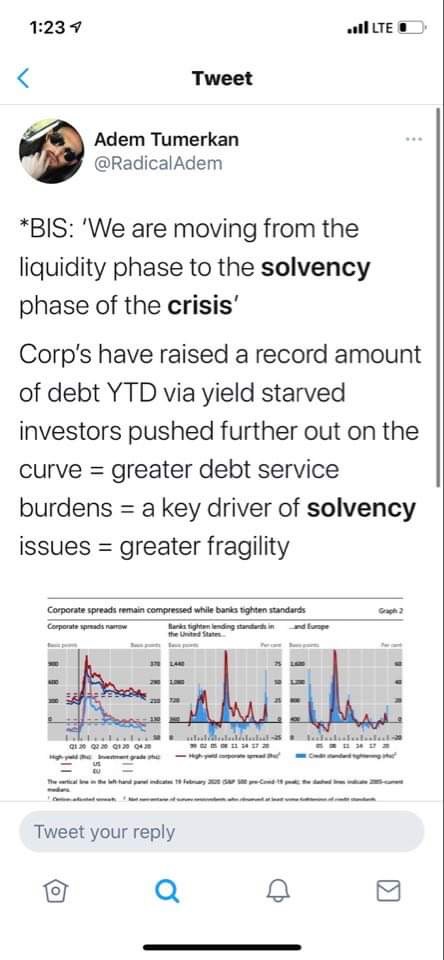

This pyramid is Exiter pyramid and it’s the flight to safety and store of value. The idea is as credit collapses and Co tracts after a 12-20 year expansion of credit, all that’s left s Gold and silver as a real currency and store of value.

The supply of gold and silver is very limited and the demand goes way up as people sell the riskier assets at the top and the money chases the few precious metals. (Supply and demand).

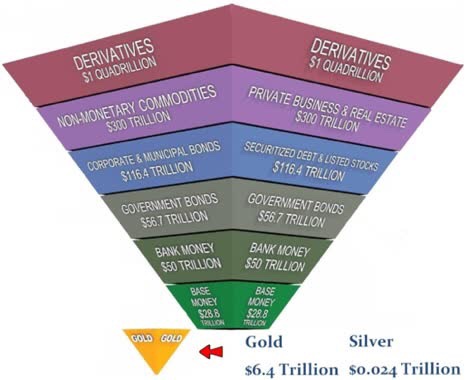

This next one blows my mind, they are saying that the money printed by the fed is 40% of the GDP (Gross Domestic Product) annually of the USA. So you’ve heard that the USA GDP is almost 70% consumption.

This is saying 40% of the money that was printed out of thin air accounted for 40% of ALL business in our economy. That’s artificial demand.

This next one really speaks to the fact of how much money has been put into circulation in the last 20 years. The idea is that the money has to be parked somewhere, so is it any wonder that al of these assets went way up in value. They should have with all of the extra money. You don’t want a sell off where that money goes to mainstreet and groceries because then prices go way up and get inflated.

I put out a lot of information for you in this post and it’s a lot to learn and take in, so keep following and learning each day. There is a lot going on in the world and a lot of risk for people to lose money that they saved up for retirement.

If you are from Minnesota and want to figure out any hedges to the inflation of your savings I’d recommend cash flowing real estate, possibly house hacking, to build income streams.

For example we could talk to you about buying a Minnesota home and renting out rooms in your house.

You could rent out the basement through Airbnb. You could buy a 4 plex with FHA financing with as little as 3.5% down and rent out the other units with the idea that you are going to owner occuply the property. When you live there 2 f the last 5 years you could qualify for up to $500.000 as a universal tax exclusion from your home residence.

This is not financial or tax advice, but simply letting you know options that exist fr your fitore as a hedge against the inflation that you can see coming that’s quickly eroding your retirement.

Get some retail income, setup a rental property as an owner occupied and you can position yourself in a very smart way. Being in real estate since I was young around 1998 and investing since 2002 I can offer you some perspectives and introduce you to some different minnesota real estate investors to help you advance your retirement and future.

This post is meant to inform and educate you and show you that you can be in control of your future and head towards the solution to give you a future that airs you feel safe af secure.

These are very big investment decisions that you can do with your retirement income and savings and they can really help your family and future.

If you want to invest in Minnesota real estate, click this link please read one of my articles with that link. My Minnesota contact info to text me is included in that article linked above.

If this sounds like you, click here

“I’m ready, I’ve decided it’s time to sell my mn home as-is, fast cash offer!”

To get more Content on this topic take a moment to click and subscribe to my social media channels below…