Self-employed tax write-off

buying a Minnesota contract for deed home

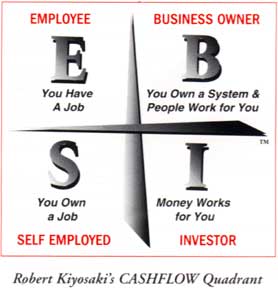

It’s a common problem I hear in Minnesota where a self-employed business owner has a hard time qualifying for a bank loan for a number of reasons.

Some of the most popular reasons are other than the down payment. For example a bad credit score would be one reason, it even a successful self-employed business owner with excellent credit that’s been self-employed for under 2 years will often have challenges getting financing for a bank loan.

One of the most common problems that really stumps a successful self-employed person his had excellent credit and has made great money for many years still can’t get a regular bank loan and the reason that I often hear is that they make a lot of money, but their tax account helps write-off as much income as possible on their annual taxes, so they don’t show a lot of taxable income.

Because of this they won’t fit in the debt-to-income (DTI) box for most lenders when it’s time to do the loan and then resell that packaged loan, so the self-employed business owner will perpetually rent for years and years when he/she really wants to own a home.

Here is how this problem is solved today for you. Even the bank statement programs with banks for the self-employed will require a bigger down payment.

The solution buying a Minnesota contract for deed

The solution can be to buy a contract for deed home here in Minnesota with a 10%+ down payment which will be faster and easier than a bank loan.

Then in the future when the timing and fixed interest rate programs make sense typically after at least 6 months you could refinance into a bank loan which is easier than a purchase loan.

This is a path or least resistance for a self-employed home buyer here in Minnesota if you make decent income monthly and can come up with a down payment.

Don’t worry about the bank financing part for now, just keep doing great with your business tax write-offs and income earning potential and save that down payment.

When you are ready to start the conversation on how the program works and all of the homes that you have availAble to you then click the motivated buyer link on my website and read about the programs and click on the link to message me and let’s chat sometime.

With A big enough down payment on your next home, you can buy on a contract for deed…

-Even with a bad credit history

To get more Content on this topic take a moment to click and subscribe to my social media channels below…