Fed, US Economy and selling my Minnesota home as-is fast cash

The national debt at the end of 2020 is over $27 trillion, unfunded government liabilities like social securities, pensions and more are estimated at over $200 trillion dollars. Global debt is now at $277 trillion dollars. Debt is 365% of world GDP

The US dollar is being devalued daily. What do you think is happening with this run away debt in America. We are leaving an unlimited debt buden for our grandkids generation.

I can show you charts where in early 2019 that local Minnesota house prices shot up just as interest rates were quickly cut in half. Interest rates are now in the low 2’s%

The reason that supply and demand forced Minnesota home prices to go up so much from 2019 to 2021, even through a recession, is that Minnesota home buyers buy based on the affordability of their monthly payment based on their wage or income sources.

This is why Minnesota home refinances have skyrocketed in recent months in 2020 as interest rates have dropped about 15+ times.

Before we get into the rest of this article I will leave a way for you to text me in the two articles

How to Sell my Minnesota home fast

We will go through the process of thinking through the steps as we will help you on your journey.

How to buy a Minnesota home with financing or with seller financing with a big enough down payment

Contract for deed is a great way to buy a Minnesota home with bad credit or as a self-employed business owners.

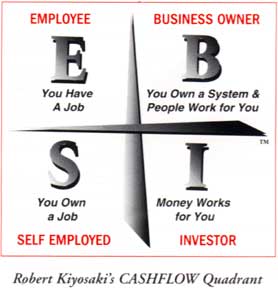

Our future, your future and your retirement have challenges that we didn’t see decades ago when you signed up for decades of 9-5 jobs.

After decades of the daily job of punching in and out and waking up to the alarm clock at 6 am and then dragging yourself out of bed, trying to stay awake just long enough to get stuck in traffic until you get a chance to work the full day only to start your journey on the way home back with bumper to bumper traffic.

Now with remote working we don’t have this traffic issues, and we do have the flexibility some for ours, but the remote schooling has changed things up a bit.

Safe Fixed Rate Returns

None of this article is meant as investment advice please do your own research to educate yourself on all investments.

Over the decades many baby boomers and retirees looked to take all of their billions of dollars into safe fixed interest rate investments like pension funds.

Back when Bonds, Treasuries, Bank CD’s paid 3 to 5 % annually on investments a retired person could have $1 million and live a conservative retirement with that amount.

I’ve heard of .1% payouts from the bank savings are barely any return above zero on treasuries, bonds, etc. many try to diversify their 401ks over the years into something safe, but safe return on investment hasn’t been exciting with the near zero environment.

Because of the low returns everywhere many talk about people speculate and bet on momentum of future investments. Let’s get into some of the numbers and risk that you see out there.

High Risk, betting, Speculating and Gamblimg with our Retirement money

This video below is the retirement crisis is phenomenal and for almost an hour you will get a jam-packed amount of information and so many charts about the coming demographic time bomb. You will understand how the networth and future crash and pension crisis is going to hurt retirees. Click to watch this video

Bitcoin, Crypto, Tesla

As I wrote this on the early morning January 1st 2021 we saw a 400% return for bitcoin and nearly 750% on Tesla this year. Others crypto’s are all over the place. Many see huge momentum with Tesla as its market cap is nearly equal to every automaker all over the world together with only about 1/2% of the car market, so the research, the stocks gone straight up.

Bitcoin is going up like crazy with the whole tether thing going on. Research what’s going on, I believe the FED printing is allowing these investments to go straight up, it feels artificial To me.

People see bitcoin as a hedge against the inflation of all of the FED printing of the US dollars even though it’s mostly digital. So you’ll see an inverse that as the US dollar gets debased that more likely gets put into bitcoin.

Most want to hodl and few want to sell. Bitcoin market cap just passed Berkshire Hathaway market cap in the last 24 hours at the end of 2020 and about 72 hours ago it passed Visa’s market cap

Just be aware that one of the top 5 crypto’s Ripple has some SEC news come out and it crashed 70% within about 1 week, so it’s something to be aware of if you transferred your 401k or even did a full cash out refi of your home equity.

Dependent on the Fed

At the End of 2020 it’s being said that the fed is as much as 40% of the total GDP of the USA. That means money being circulating and helping business and everyone grow in the USA, 40% can be attributed to the FEDs printing, that’s insane.

I saw an article in the summer of 2020 that 25% of all income in the USA comes from the Government. With food stamps, unemployment, stimus, bonus money, disability, grants, people are more dependent than ever and addicted to the governments money to survive.

Look up the charts of M1 & M2 money supply below. The M2 money is generally less liquid like savings where M1 is more about like checking accounts, last few weeks of 2020 data was released with an enormous spike where M2 went down where M1 skyrocketed so many believe that’s people moving money from savings to checking for some reason to be more liquid. Possible for year end bills or businesses are losing money.

Let’s look at the printing of the money , debasement. What this is saying the lending of new loans is money printing which debases the currency but flows into investments like stocks , and bitcoin thus huge asset inflation.

With Gregory post below I’m concerned about a Liquidity Crisis, Bank Runs, or Access to Cash. He’s saying that there is $2.02 trillion physical dollars the rest is digital and paper money. If people ever want to hold their money or put it in their house or just hold it, the money isn’t there it’s all digital and gets traded or days and weeks, it’s not that liquid. With a bank run or a flight to safety to gold and silver everything will get very interesting.

A comment here showing that the average bank doesn’t have that much physical cash, again it’s all digits, so imagine if just 1 or 2 people want led all of their savings, the bank just wouldn’t have it, people have saved for decades and haven’t been spending it down, but are retiring now do they’ll need to liquidate and spend down their investments.

Fed buying MBS mortgage Back Securities

Another concern is that real estate is 18% of GDP in the USA and real estate agents and mortgage brokers and lenders sell their loans im securities based ok interest rates and a return. That’s how mortgage brokers and banks can keep doing loans because the replenish by selling,

This is liquidity in the real estate industry. The fed now is buying the mortgage back securities, much of it over $2 trillion, that’s influencing the market and keeping interest rates low and not pricing in real risk with interest rates with a true free market.

You can tell back near the last real estate crash the fed owned zero mortgage back securities, so as other lenders don’t buy, it’s taking the fed, the buyer of last resort.

Also keep in mind that the fed is backing Fannie Mae, Freddie Mac, Ginnie Mae, GSE’s. So it’s a backstop or an insurance for those companies which are highly regulated.

The fed is now buying corporate bonds, junk bonds. Nobody knows the real risk because the fed is bailing everything out.

It’s now January 1st look at some of the returns in 2020, it’s pretty incredible, but the P/E and sales ratios don’t make sense. There is a lot of money printed by the fed, so all of that money has to flood somewhere.

Look at the returns from this 2020 recession vs the 2008 recession. The complete opposite. Does that look right to you? Of course not, the printed money by the fed kept it propped up instantly after the March crash in stocks.

Look at how much the feds balance sheet grew in 2020. It’s out of control this is why most assets are imflatimg so much.

It’s also noticed that the S and P 500 is mostly ruled by 5 stocks, and now 6 stocks since Tesla was just added. There are a few tech companies getting all of the returns as the other 494 stocks haven’t done much in 2020.

So as you can see a lot of these assets are showing inflation and aren’t pricing in risk under one narrative or perspective.

I’m just here to show you what’s going on with lots of different investments by institutions and retail investors now with cashapp and Robinhood.

Now that you are considering your retirement money and what do dkk ok with it, consider selling your Minnesota home and buying an investment property for monthly cash flow that’s a good hedge for a potential crash.

I think house hacking is a good way to improve your lifestyle with cash flow and have other renters pay towards your home loan to pay it down and have you living cheap.

By doing the house hacking, duplex, triplex, or four plex you can get in now for as little as 3.5% down if you are going to live there. Also single or married, $250,000 and $500,000 universal tax exclusion when you live there 2 of the last 5 years is a huge tax deferred advantage when selling. Discuss this with your tax accountant.

You can consider selling your property on seller financing to a Minnesota investor that I know by subject to or a contract for deed.

This gives you a chance for an income stream and even a higher price for your home as the terms are favorable to a real estate investor.

I just want to see you get multiple income streams and design your future and lifestyle with your aging, health and debt top of mind. We live in strange times with COVID-19, shutbduu I was, masks and limitations of freedoms, so I want to help you get some of it back with flexibility on your lifestyle.

When you buy a bigger property you can have extra room for a remote office or remote school area for their schooling via zoom. Maybe traffic and location changes from the cities to the suburbs.

It’s time to stop stressing out daily and being worried with your thoughts and emotions and go for clarity into your future. Do it for your family’s future.

The truth is you really can’t afford to lose money and time. What I mean is with a crash you can’t afford to wait a few decades like Japan for a full rebound. If you lose 50% on your assets you need to make a 100% return just to get jack to break even. Don’t lose decades by making a big mistake with too much risk.

You are looking for more certainty in a very uncertain world, so I’d love to talk to you by text sometime to discuss some options that make sense to you based on a lot of the information above.

If this sounds like you, click here

“I’m ready, I’ve decided it’s time to sell my home fast.”

To get more Content on this topic take a moment to click and subscribe to my social media channels below…

The information below is not meant for investment advice please do your own research for your future retirement.